| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-06-25 | |

| Infographic Update | Ranjeet Kumar | Apr-04-25 |

Read Next

- What is Commodity Valuation?

- Exchange of Futures for Physical (EFP)

- Commodity Arbitrage – Types & Strategies in India

- Top Major Commodity Exchanges in India

- The Pros and Cons of Commodity Trading

- What is the Commodity Index?

- Types of Commodity Market in India

- Tax on Commodity Trading in India

- Understanding Commodity Market Analysis

- Risks in Commodity Trading and How to Manage Them

- 5 Tips for Successful Commodity Trading

- Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders

- Commodity Trading Regulations in India: SEBI Guidelines & Impact

- What is the Timing for Commodity Market Trading?

- How to Trade in the Commodity Market?

- What is Commodity Market in India?

- What Is the National Commodity and Derivatives Exchange (NCDEX)?

Stock Market vs Commodity Market

Investment is one of the most crucial routes to the creation of wealth and to financial growth. Two of the most sought-after markets in this arena are the stock market and the commodity market. While both offer attractive investing and trading opportunities, their nature of assets, workings, and objectives are quite different in essence. The differences must be understood by investors to make informed investment decisions.

In this blog, we look at the difference between equity and commodity markets, their features, advantages, and suitability so you can decide which market is right for your financial needs.

What is the Stock Market?

The stock market, which is also called the equity market, is where people can buy and sell shares of listed companies. Investors buying shares make them a partial owner of that firm and give them the right to vote on issues affecting the company.

How the Stock Market Works?

The buying and selling of equity shares in the Indian stock market occurs on two exchanges, i.e. the National Stock Exchange and the Bombay Stock Exchange in India. It offers a structured and regulated platform for trading stocks and other securities.

- Financial Instruments: Stocks, exchange-traded funds (ETFs), and derivatives like options and futures are common instruments.

- Participants: Those engaging in the Indian stock market are retail investors, institutional investors, mutual funds, and hedge funds.

- Regulatory Body: In India, the stock market is governed by the rules and regulations governed by the Securities and Exchange Board of India to ensure transparency and fairness.

Read in Detail – How Does the Stock Market Work in India?

Types of Stock Markets

- Primary Market: This market features a company issuing new shares to the public through an IPO process. The investors buy newly issued shares directly from the company.

- Secondary Market: The shares issued in the primary market are traded among various investors in the secondary market.

Key Features of the Stock Market

- Liquidity: Shares of well-known companies can be easily bought and sold due to high liquidity.

- Long-term Growth Potential: The returns from equity investments, when held for a long period, can be substantial.

- Risk and Volatility: The prices of the shares fluctuate due to market trends, economic factors, and company performance.

- Ownership Rights: Shareholders are the partial owners of the company and are entitled to dividend income or to participate through voting in any significant decisions.

Read Aslo – Best Stock Market Web Series & Movies to Watch

What is the Commodity Market?

The commodity market is the market for trading raw materials and natural resources. Resources which are traded here are: agricultural products, energy sources, and precious metals. This marketplace provides opportunities to producers, consumers, as well as speculators to hedge as well as profit from short term price movements.

How the Commodity Market Works?

Commodities are physical assets and are traded as spot contracts or futures contracts.

- Trading Instruments: Commodities such as gold, silver, crude oil, wheat, and coffee are traded in the form of either spot contracts or derivatives.

- Participants: Some of the key players involved in the commodity market are the producers-farmers or miners-and consumers-industries, along with speculators and traders.

- Regulation: The commodity markets in India are regulated by SEBI and function through some of the following platforms- Multi Commodity Exchange, National Commodity and Derivatives Exchange.

Types of Commodities

- Hard Commodities: These include all naturally occurring resources which come directly from the earth such as crude oil, gold and silver.

- Soft Commodities: These consist of agricultural products, which would include wheat, coffee, cotton, etc.

Important Features of the Commodity Market

- Hedging Opportunities: Commodity trading Plateform is used by market participants to hedge against adverse price movements.

- High Volatility: Commodity prices are greatly influenced by global supply and demand, geopolitical issues, and natural catastrophes.

- Speculative Opportunities: High volatility attracts speculative traders looking to benefit from massive price movements.

Read Also – How to Trade in the Commodity Market?

Key Differences Between Stock Market and Commodity Market

| Aspect | Stock Market (Equity) | Commodity Market |

|---|---|---|

| Nature of Assets | Shares of companies (intangible assets) | Physical goods like gold, oil, and wheat |

| Objective | Long-term growth and ownership | Hedging, speculation, and short-term profit |

| Participants | Retail investors, mutual funds, institutions | Producers, consumers, speculators, traders |

| Risk Factors | Market trends, economic factors, and company performance | Price volatility due to supply-demand dynamics |

| Market Platforms | NSE, BSE | MCX, NCDEX |

| Investment Horizon | Long-term (years or decades) | Short-term to medium-term (weeks or months) |

| Regulation | Governed by SEBI | Governed by SEBI |

| Returns | Dividends, capital appreciation | Profits from price fluctuations |

Check Out – Commodities Screener

Advantages and Disadvantages of Commodity Market

The advantages and disadvantages of the commodity market are:

Advantages

- Diversification: Commodities act as an inflation hedge and allow for the diversification of portfolios.

- Hedging Opportunities: Businesses dealing in commodities as an end product or raw material can hedge risks through futures contracts.

- High Returns: Speculators can achieve high returns during volatile market conditions if they correctly predict the market direction.

Disadvantages

- High Volatility: The price of commodities can be severely impacted by unexpected events such as natural disasters and geopolitical actions.

- Complex Market Dynamics: Global trends and commodity-specific factors require expertise to understand.

- No Recurring Income: Commodity investments do not provide a recurring income, unlike equities that offer dividends.

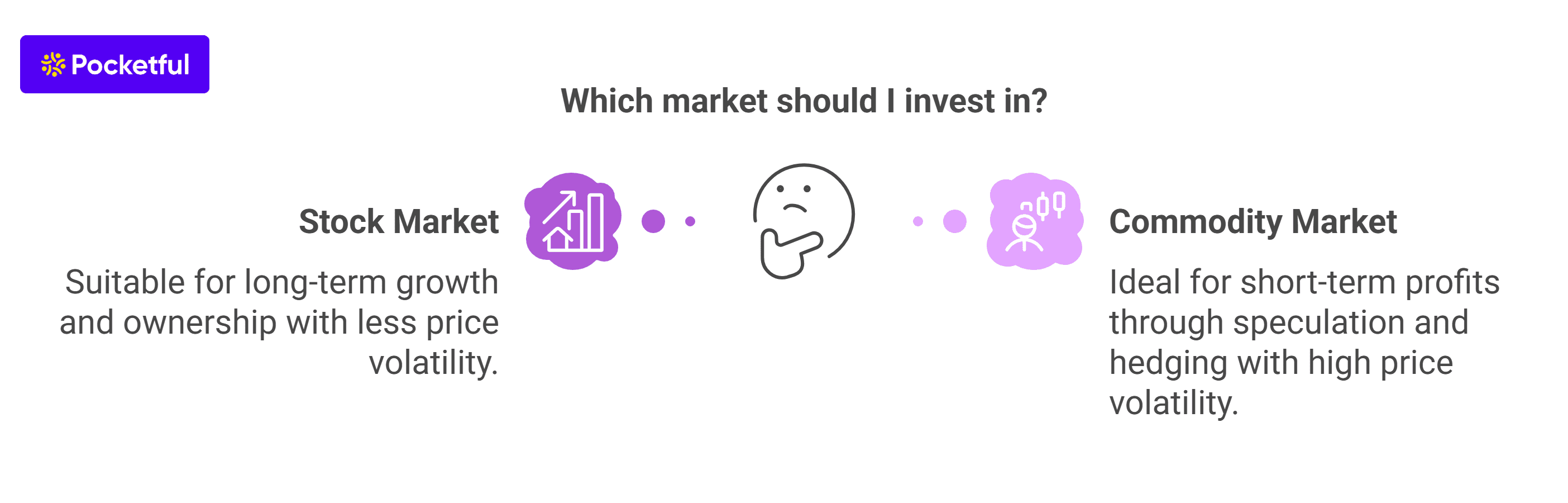

Which Market is Right for You?

It largely depends on your financial goals, risk tolerance, and expertise level for you to determine whether you should invest in equity or commodity markets.

Stock Market is Right for You If:

- You are willing to invest for long-term wealth creation.

- You wish to invest in growing businesses.

- You have a moderate to high-risk appetite and can tolerate market fluctuations.

Commodity Market is Right for You If:

- You want to hedge against inflation or adverse price movement in the commodity prices.

- You are an expert in analyzing the global commodity market trends and supply-demand factors.

- You are interested in short-term speculative trading opportunities.

For instance, a person looking for steady wealth accumulation over time may prefer the stock market. A trader who wants to capitalize on price fluctuations may find the commodity market more suitable.

Read Also – Top 10 Sectors in the Indian Stock Market

Conclusion

The stock market and the commodity market represent two different avenues through which wealth can be created. The difference between equity and commodity is based on the underlying assets, the kind of market participants involved, the financial objectives of individuals, and the inherent risks. While the former features shares that represent ownership in companies and individuals investing with the goal of long-term growth, the commodity market is for people looking for short-term trading opportunities, hedging and diversification.

The choice between the two would basically depend on your financial goals concerning investments, risk tolerance level, and knowledge of each market. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What is the difference between equity and commodity markets?

Their underlying assets are one of the key differences between the two, as the equity market deals with company shares, whereas a commodity market focuses on raw materials and natural resources.

Which is relatively riskier: equity or commodity?

Commodity markets tend to be slightly more volatile than the equity market as they mainly feature derivative contracts and due to other factors like global tensions, natural disasters, etc.

Can I invest in both equity and commodity markets at the same time?

Yes, many investors diversify their portfolios by participating in both equity and commodity markets to balance risk and returns.

Is commodity trading profitable in India?

Commodity trading can be profitable for those who understand market dynamics and employ effective risk management strategies.

How do I choose between equity and commodity investments?

Consider your financial goals, risk, and market knowledge. An individual looking for long-term growth can participate in equity markets, whereas commodities markets are ideal for those looking for short-term trading and hedging.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle