| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-07-25 |

MCX Trading: What is it? MCX Meaning, Features & More

MCX is essentially India’s principal commodities trading exchange in terms of volume and efficiency. The MCX full form is Multi Commodity Exchange. It is the largest commodity exchange in the country, offering futures and options contracts for a wide variety of commodities.

MCX serves as a crucial bridge between buyers and sellers of a commodity, enabling market participants to capitalize on market fluctuations and hedge against adverse price movements. In this blog, we will discuss the process of trading on MCX through a registered broker and its features and advantages.

What is MCX?

Multi Commodity Exchange, or MCX, is the leading commodity exchange in India. It was established in 2003 and is regulated by the Securities and Exchange Board of India (SEBI). MCX offers a platform for trading futures and options contracts of metals, energy, etc.

Derivative contracts available on MCX let traders speculate on price swings and hedge against the risks associated with commodity price fluctuations. For companies reliant on commodities as raw materials—such as manufacturing or an FMCG company—hedging using futures contracts can help them fix the costs of raw materials.

Features Of MCX Trading

The features of trading on MCX are:

1. Wide Range Of Commodities

MCX offers derivative contracts on industrial metals, precious metals, energy, etc., helping traders capture more trading opportunities in multiple commodities simultaneously and reducing the risk associated with a specific commodity.

2. Futures Trading

Futures contracts are standardized contracts with underlying assets of a specified quality and quantity. Individuals involved in commodity trading don’t need to worry about the quality of assets getting delivered at expiration as the underlying asset is stored at authorized storage facilities.

3. Regulated By SEBI

MCX is regulated by the Securities Exchange Board of India (SEBI) to ensure security and transparency. Strict laws boost the trust of market participants and help protect market integrity. It also ensures that every transaction is under observation, therefore establishing a fair trading environment.

4. Electronic Trading Platform

Effective price discovery and quick order execution are features of the electronic trading system, helping traders focus on developing their strategies and other aspects instead of order execution.

5. High Liquidity

High liquidity lets traders create and exit positions quickly, helping them modify their positions in response to changing market conditions. It also reduces the bid-ask spread, therefore enhancing cost-effectiveness.

6. Leverage

Leverage enables traders to create a much larger position using much capital. It raises profit potential but also increases risks. When used judiciously, this feature lets traders increase their returns even with limited capital.

Popular Commodities Traded On MCX

The table below shows the most traded commodities on the exchange:

| Category | Commodities |

|---|---|

| Metals | Gold, Silver, Copper, Zinc, Lead |

| Energy | Crude Oil, Natural Gas |

| Agriculture | Cotton, Mentha Oil |

Given their cultural significance, gold and silver remain amongst the most traded commodities. Natural gas and crude oil are crucial for the energy industry, and their prices are based on world supply and demand. Derivative contracts on agricultural goods like cotton and mentha oil give traders an opportunity to speculate based on future price movements.

Read Also: MCX Exchange Case Study: Evolution, Products, And Financials

Advantages Of Trading on MCX

The advantages of trading on MCX are:

- Hedging: Futures contracts can be used for hedging, allowing businesses to reduce their input costs and producers to fix the selling price of their commodities. This helps businesses to maintain their profit margins against unanticipated market price fluctuations.

- Leverage Trading: Leverage allows traders to take larger positions with a smaller initial capital outlay. Leverage has advantages as well as risks, as both your returns and losses will increase.

- High Liquidity: High liquidity reduces price volatility, enabling smooth and quick trade execution. Liquidity reduces the bid-ask spread, therefore lowering transaction costs.

- Price Discovery Mechanism: The price discovery mechanism helps businesses determine the prices of raw materials based on market supply and demand. With a centralized exchange, every market participant knows the fair price at which the commodity is traded, helping them avoid overpaying for a commodity in the spot market.

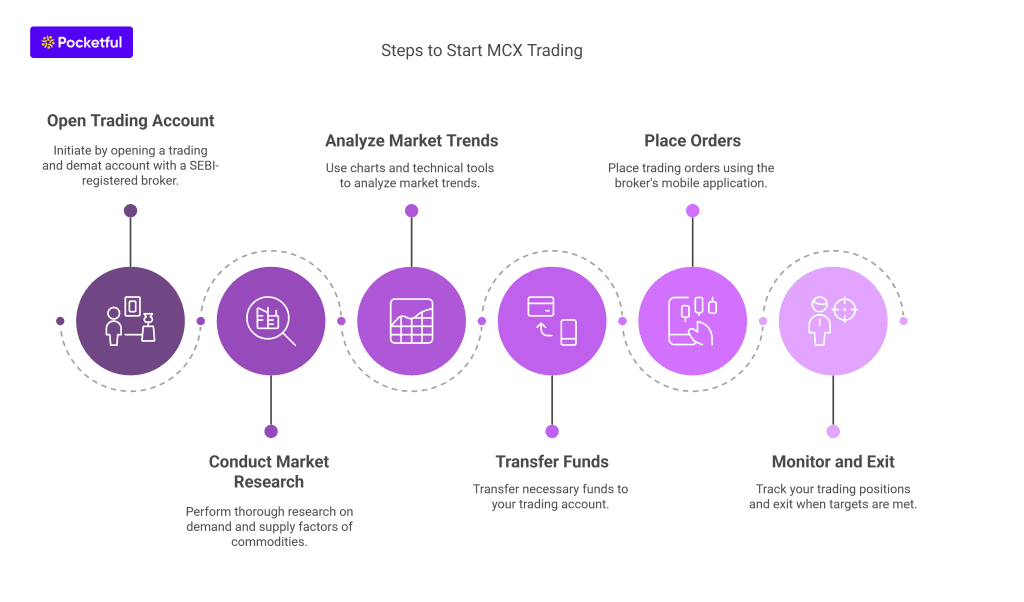

How To Start MCX Trading?

Follow the below steps for MCX trading:

- Open up a trading and demat account with a SEBI-registered broker, offering the facility to trade on MCX.

- Do thorough market research related to the demand and supply factors of a specific commodity.

- Analyze market trends using charts, indicators, and other technical analysis tools.

- Transfer funds to your trading account and place orders using the mobile application provided by your broker.

- Track your position and exit once the target or stop-loss is hit.

Success in MCX trading calls for both a focused strategy and knowledge of market trends. Staying updated about market trends and continuous education is essential to long-term success.

Risks Of MCX Trading

Trading on Multi Commodity Exchange also has risks. Some of the prominent risks involved in trading commodities are mentioned below:

- Price volatility: The commodity prices are significantly influenced by geopolitical tensions, supply-demand imbalances, and world economic events. Market risks develop when unexpected events alter the cost of goods, therefore generating probable losses for companies using commodities as raw materials.

- Leverage: Leverage allows traders to create a much larger position with limited capital, raising the possibility of both gains and losses. To avoid high risks, traders should use leverage carefully.

Conclusion

Using SEBI-registered brokers allowing trading on MCX gives traders a great opportunity to participate in the commodities market. Making smart trading decisions requires a well-defined trading strategy and awareness of the features and risks associated with MCX trading.

The wide selection of commodities helps market participants hedge and speculate on future price movements. However, it is important to consult a financial advisor before trading in commodities.

Frequently Asked Questions (FAQs)

What is MCX trading?

MCX trading involves buying and selling standardized commodity derivatives like futures and options on the Multi Commodity Exchange, enabling traders to speculate or hedge against price fluctuations.

How can I start trading on MCX?

To begin MCX trading, open a trading and demat account with a SEBI-registered broker, fund your account, analyze markets, and place orders via the broker’s platform.

What commodities are traded on MCX?

MCX offers derivative contracts on metals like gold and copper, energy commodities like crude oil and natural gas, and agricultural products such as cotton and mentha oil.

Is MCX regulated and safe to trade on?

Yes, MCX is regulated by SEBI, ensuring a transparent, secure trading environment with strict compliance to protect investors and maintain market integrity.

What are the risks of MCX trading?

Risks include price volatility due to global events and leverage-related losses. Traders must use risk management and stay informed to exit risky trading positions and avoid significant losses.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.