| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-28-24 | |

| Add new links | Nisha | Mar-18-25 |

- Blog

- ultratech cement case study financials statements swot analysis

Ultratech Cement Case Study – Financials Statements, & Swot Analysis

The concrete jungle keeps getting bigger, and cement is the heart of it. Today, we will talk about Ultratech cement, a major player in India and a big name worldwide and learn about the fascinating journey of Ultratech. Let us explore how this company evolved as a dominant force in the industry, its strengths, and the countless structures they have built.

Ultratech Cement Company Overview

Ultratech Cement is India’s largest manufacturer of gray cement, ready-mix concrete (RMC), and white cement. The company is a part of the Aditya Birla Group, one of India’s largest conglomerates. The company has a strong presence in India, with a manufacturing network of 24 integrated manufacturing plants and 33 grinding units. It also operates in the UAE, Bahrain and Sri Lanka,

In 1983, Ultratech Cement began as the cement division of Larsen & Toubro (L&T) and was sold under the brand name of “L&T Cement”. In 2004, L&T Cement was demerged from its parent company and acquired by the Aditya Birla Group. This acquisition led to the formation of the Ultratech Cement.

Ultratech Cement Product Portfolio

The company’s products and services are categorized as follows,

Core Products

- Grey Cement: Used in various construction applications such as buildings and infrastructure projects.

- White Cement: It offers a high-quality finish for architectural applications and decorative purposes.

Value-Added Products

- Ready-Mix Concrete (RMC): Pre-mixed concrete delivered to construction sites, ensuring consistent quality and convenience.

- Building Products: A range of scientifically formulated products like wall care putty catering to modern construction needs.

The company holds integrated manufacturing plants to produce clinker, the primary raw material for cement, grinding units to grind clinker into finished cement powder near consumption centers for efficient distribution and bulk packaging terminals to facilitate bulk transportation and storage of cement.

Furthermore, the company’s primary revenue source is derived from selling cement, ready-mix concrete (RMC), and other building products.

It focuses on enhancing operational efficiency to control production costs and optimize resource utilization effectively. The company also leverages its substantial production capacity and expansive network to attain cost advantages through economies of scale.

Ultratech Cement – Key Highlights

- Over 150 MTPA production capacity

- 22,916 total employees

- 120 crores spent on CSR projects

- 24 integrated units & 33 grinding units

Read Also: Grasim Industries Case Study: Subsidiaries, Products, Financials, and SWOT Analysis

Ultratech Cement Consolidated Financial Statements

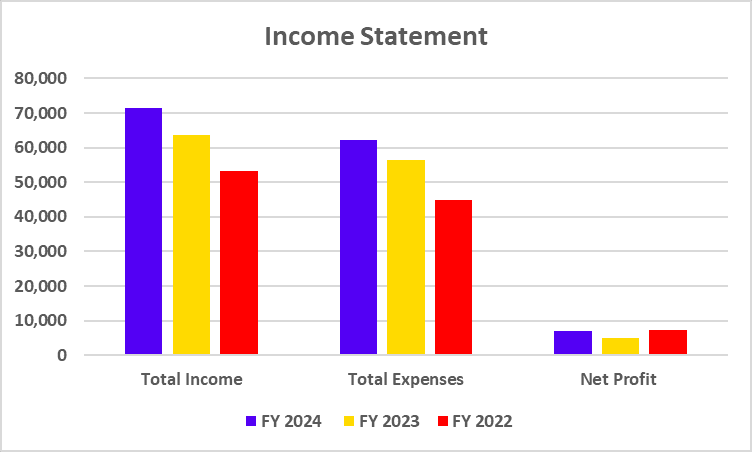

Ultratech Income Statement

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Income | 71,525 | 63,743 | 53,106 |

| Total Expenses | 62,052 | 56,330 | 44,743 |

| Net Profit | 7,003 | 5,073 | 7,334 |

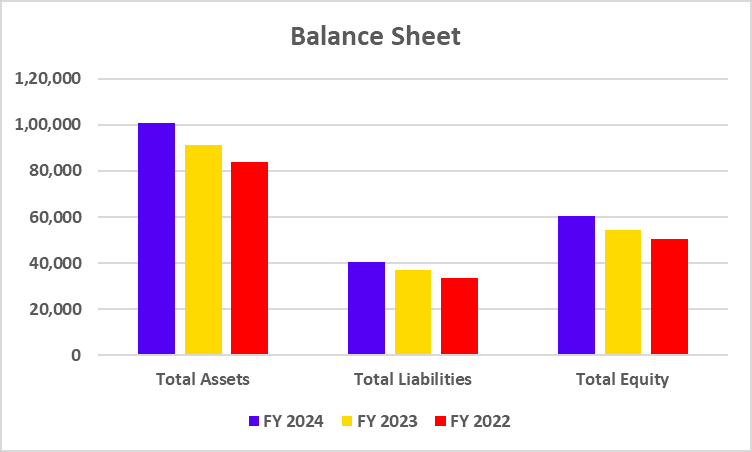

Ultratech Balance Sheet

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Assets | 1,00,802 | 91,386 | 83,827 |

| Total Liabilities | 40,517 | 37,006 | 33,395 |

| Total Equity | 60,227 | 54,324 | 50,435 |

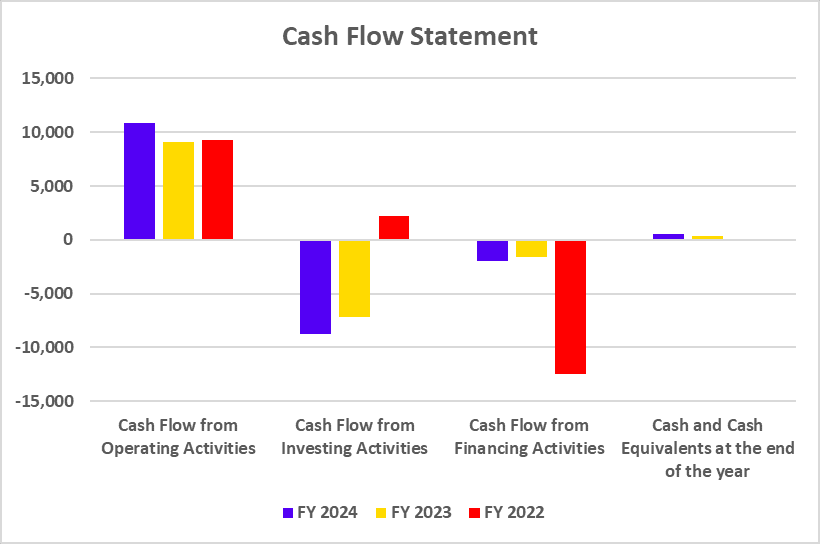

Ultratech Cash Flow Statements

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | 10,898 | 9,068 | 9,283 |

| Cash Flow from Investing Activities | -8,788 | -7,187 | 2,257 |

| Cash Flow from Financing Activities | -1,925 | -1,631 | -12,497 |

| Cash and Cash Equivalents at the end of the year | 553 | 370 | 120 |

Inferences drawn from the above financial statements are as follows.

- Ultratech has shown consistent revenue growth over the past three years.

- While revenue has grown, net profit in FY 2023 decreased compared to FY 2022. The decline could be due to rising input costs or increased expenses.

- To sum it up, the company’s overall health remains robust despite the decline in net profit for FY 2023. Net profit bounced back to near previous levels, and it appears to continue performing well, with growing revenue and profitability.

Ultratech Cement SWOT Analysis

Strengths

- Ultratech benefits from the support of the Aditya Birla Group, and it possesses a robust brand identity and esteemed status within the Indian market.

- The company offers a wide range of products, including gray cement, white cement, ready-mix concrete, and building products.

- Its large distribution network gives it a strong presence in India and international markets.

- The company exhibits a strong dedication towards sustainability, exemplified by its substantial allocations towards energy efficiency, renewable energy, and the mitigation of carbon emissions.

Weaknesses

- Acquisitions and expansions have increased debt levels, which could create financial risks.

- Managing a substantial number of plants and operations across multiple locations can give rise to inefficiencies and escalate operational costs.

- A notable proportion of the company’s revenue is derived from the Indian market, exposing it to regional economic downturns.

- The Indian cement industry is competitive, with many major players competing for market share.

Opportunities

- India’s ongoing infrastructure development projects present a tremendous opportunity for escalated cement demand.

- As a prominent cement exporter, the company can take advantage of global markets with a strong brand identity.

- Urbanization and government focus on affordable housing can boost the cement sector.

Threats

- Fluctuations in raw material prices, such as coal and limestone, can significantly affect production costs and profitability.

- The cement industry emits a lot of carbon because of the raw materials, making it difficult for the sector to reduce greenhouse gas emissions. Any new global regulation to reduce emissions can impact the company’s profit margins.

- Climate-related risks to assets and supply chains due to extreme weather events like floods, cyclones, and droughts.

Read Also: One MobiKwik Systems Case Study: Business Model, Financials & SWOT Analysis

Conclusion

To wrap it up, Ultratech Cement is a powerhouse in the Indian cement industry, asserting its dominance and making a significant impact on a global scale. The Aditya Birla Group legacy and a well-defined business model provide strong backing for Ultratech, which enjoys robust brand recognition, an extensive network, and a steadfast commitment to quality. While confronting fierce competition and relying heavily on the domestic market, Ultratech finds itself in a favorable position to achieve future success. The focus on innovation, expansion of product lines, export opportunities, and adoption of sustainable practices has the potential to create new growth opportunities.

Frequently Asked Questions (FAQs)

Who owns Ultratech Cement?

Ultratech Cement is a part of the Aditya Birla Group, one of India’s biggest conglomerates.

What is the current market price of Ultratech Company?

The company’s current market price stands at INR 11,687.

Who are Ultratech’s customers?

They cater to individual builders, large construction companies, and government projects.

Is the company environmentally conscious?

Yes, Ultratech prioritizes sustainable practices and eco-friendly cement production.

How long has Ultratech been around?

Their roots go back to the 1980s when it started its journey as a cement division of L&T.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.