| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-07-23 | |

| Add new links | Nisha | Mar-18-25 |

- Blog

- understanding the difference between credit and debt

Understanding the Difference Between Credit and Debt

What is Debt?

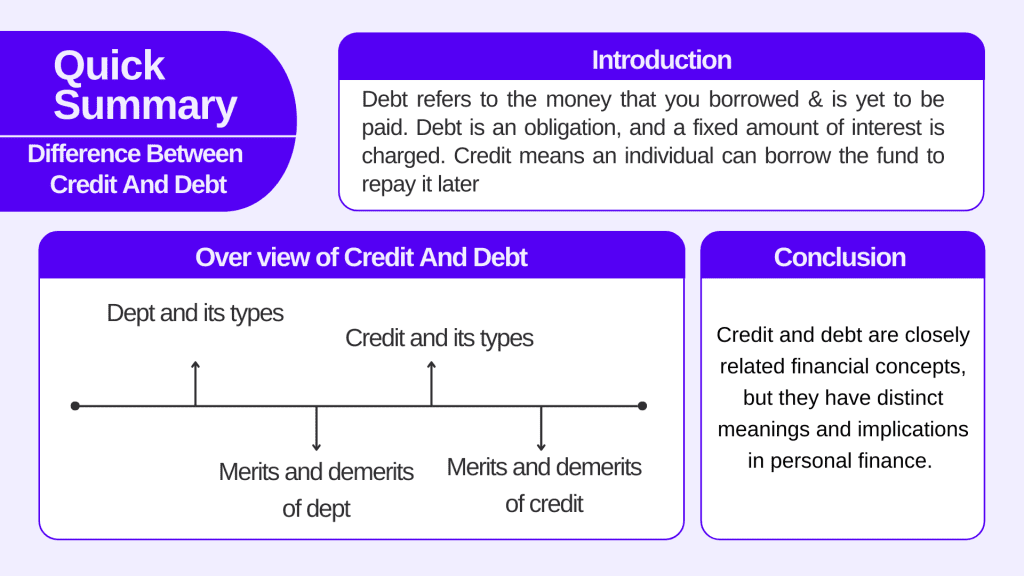

Debt refers to the money that you borrowed & is yet to be paid. Debt is an obligation, and a fixed amount of interest is charged. It is suggested to avoid taking debts since later you may find it difficult to repay. Examples of debts are home loans, credit card bills, car loans, mortgages, personal loans, etc. Debt characterizes a financial burden.

Types of Debt

Debts can be categorized into the following types

- Secured Debt

- Unsecured Debt

- Revolving Debt

Let us go through each of the types in detail.

Secured Debt

Secured debts are backed by collateral such as assets, investments, or property. In this debt, if the borrower fails to repay the debt amount, the lenders seize the borrower’s collateral, and the debt is covered from the same.

Unsecured Debt

Unlike secured debts, unsecured debts are not covered by any collateral as security. These debts are granted to the borrower once the lender relies on him. The approval depends on the payment of the past debts. For example, education loans and automobile loans.

Revolving Debt

A debt that does not have a fixed payment amount every month is known as a revolving debt. The payment amount and interest rate depend upon the amount that you borrow. Once the borrower repays the existing debt amount, he can again borrow either the same or a different amount. It is like a line of credit. Credit card is an example of revolving debt.

Merits Of Debt

- Debt can help you achieve your financial goals by leveraging your current resources.

- Debt can offer individuals, corporations, and governments immediate access to funds in case of emergency.

- Paying your debts on time can help you improve your credit score.

Demerits of Debt

- Borrowing money typically comes with interest costs. The interest payments can add up over time, making the overall cost of the debt higher than the initial borrowed amount.

- Failing to make debt payments can lead to default, resulting in penalties, fees, and damage to credit score.

- High debt can lead to anxiety and financial stress because monthly payments can be a burden.

- Long-term debts can land you in a cash crunch, and your savings capacity will also be affected.

- Debt can also lead to loss of collateral security that you must have given to the lender at the time of agreement.

Having discussed the debt, let us understand the concept of credit.

What is Credit?

Credit means an individual can borrow the fund to repay it later. Let’s say that you have a credit limit of 2 lakhs and the amount that you used from this amount to 50 thousand; then 2 lakh is your credit, and 50 thousand is the amount you owe to the creditor. Creditors decide an individual’s eligibility for credit after analyzing their past debt repayments.

Read Also: Why Debt Funds Are Better Than Fixed Deposits of Banks?

Types of Credit

Credits can be majorly categorized into 3 types

- Open credit

- Revolving credit

- Installment credit

Open Credit

Credits are like trade credits in which the goods can be exchanged between the buyer and the seller based on the buyer’s ability to repay it later on a pre-decided date.

Revolving Credit

Revolving credit allows borrowers to use credit continuously as long as they make minimum payments, including the interest charged.

Instalment Credit

When an amount is borrowed for a fixed period and fixed interest rate, you repay it monthly. EMIs (easy monthly installments) are an example of installment credit. Our readers should also know that when you pay your debt on time, you earn a credit score, which increases your creditworthiness.

What is a Credit score?

A credit score is several 3-digit, which lies somewhere between 300 to 850. The higher the credit score, the chances of you to avail a loan are more likely. A credit score of 700+ indicates that you make timely repayments of your debt amount. Some companies are known as credit rating agencies like CRISIL and ICRA that helps creditor generate a credit score.

Merits of Credit

- Just like debt, credit also provides immediate access to the funds

- Credit cards can offer the consumer financial flexibility or take advantage of time-sensitive opportunities.

- Timely repayment of credit will help you secure your loans more easily and conveniently.

Demerits of Credit

- Non-payment or late payments can lead to default and heavy interest expenses, reducing your credit score.

- Credit availability can lead to overspending, as individuals may be tempted to make purchases they cannot afford.

- If credit is used to cover recurring expenses and debt payments, it can lead to a cycle of increasing debt.

Also, read the case study of Satyam Scam.

Read Also: Credit Score: What Is It And How It Impacts You?

Conclusion

Credit and debt are closely related financial concepts, but they have distinct meanings and implications in personal finance. In summary, credit represents the ability to access resources or make purchases with the promise of future repayment. In contrast, debt represents the obligation to repay borrowed funds, goods, or services with interest, often over a specified period. Irresponsible use of credit can lead to debt accumulation, but not all credit usage necessarily results in debt if payments are made promptly.

Frequently Answered Questions (FAQs)

Are debt and credit the same?

No debt and credit are not same.

Name of credit rating agencies?

CRISIL & ICRA are 2 credit rating agencies.

Are home loans a debt or credit?

Home loans are a kind of debt.

Explain secured debt.

Secured debts are backed by collateral such as assets, investments, or property if the borrower fails to repay the debt amount, the borrower’s collateral is seized by the lenders.

Define Credit.

Credit means an individual can borrow the fund to repay it later.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.