| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-07-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- vedanta case study

Vedanta Case Study: Business Model, Financial Statement, SWOT Analysis

Imagine you are constructing your dream house, and you need some raw materials. Have you ever wondered where these raw materials come from? Companies such as Vedanta are involved in the production of these raw materials. The raw materials include steel, aluminum, copper wires, etc.

In this Vedanta Case Study, we explore the company’s overview, business model, financial performance, and SWOT analysis to understand its market position.

Vedanta Company Overview

The business was founded in 1979 under the name Sterlite Industries (India) Limited, and its initial focus was on the production of wires and cables for the telecommunications sector. In 1992, the company changed its focus and concentrated on smelting and refining copper. In 2003, the business formed a parent company in the United Kingdom called Vedanta Resources Limited, listed on the London Stock Exchange. A prominent operator in the Indian iron ore mining industry, Sesa Goa Limited was eventually purchased by Vedanta in 2007. Subsequently, the business bought Cairns India and Cairns Energy, a significant player in the oil and gas industry. The company’s headquarters is situated in Mumbai.

Business Model of Vedanta

The Vedanta Business Model has diversified operations because it operates in a variety of fields. It offers various commodities such as zinc, aluminum, iron, steel, etc. The company controls the entire value chain, which helps it achieve operational efficiency and high-quality products. The corporation can maintain a steady supply of products because of its huge natural reserves in Africa and India. The company has also completed several acquisitions to establish itself as a major player in the mining industry.

Product Portfolio of Vedanta

The corporation is a major participant in the commodities market and offers a wide range of commodities, such as zinc, lead, copper, steel, aluminum, semiconductor, etc. The company is involved in the production and exploration of natural gas and oil reserves in the oil and gas industry.

Market Details of Vedanta Ltd.

Vedanta Ltd. is a globally diversified natural resources company listed on BSE and NSE, with a significant market capitalization and an extensive portfolio in metals, mining, and energy.

| Current Market Price | INR 414 |

| Market Capitalization | INR 1,61,851 Crores |

| 52 Week High | INR 507 |

| 52 Week Low | INR 208 |

| P/E Ratio (x) | 43.9 |

Read Also: Zaggle Case Study: Business Model, Financials, and SWOT Analysis

Financial Highlights of Vedanta Ltd.

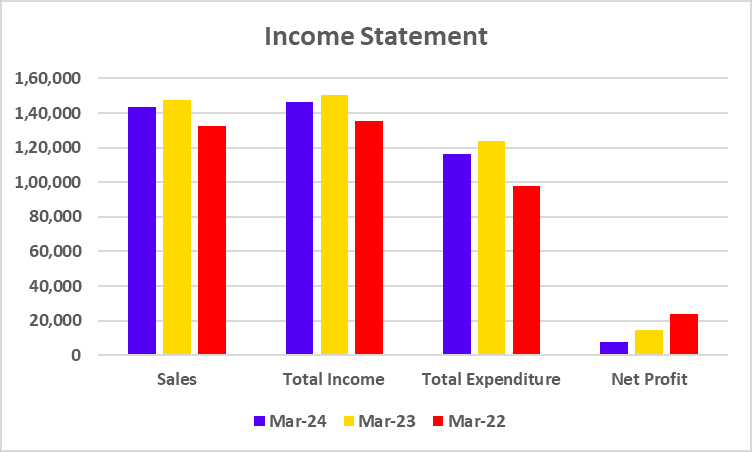

Income Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Sales | 1,43,727 | 1,47,308 | 1,32,732 |

| Total Income | 1,46,277 | 1,50,159 | 1,35,332 |

| Total Expenditure | 1,16,449 | 1,23,658 | 97,571 |

| Net Profit | 7,537 | 14,506 | 23,709 |

The above graph shows that the company’s net profit has been decreasing for the last three years.

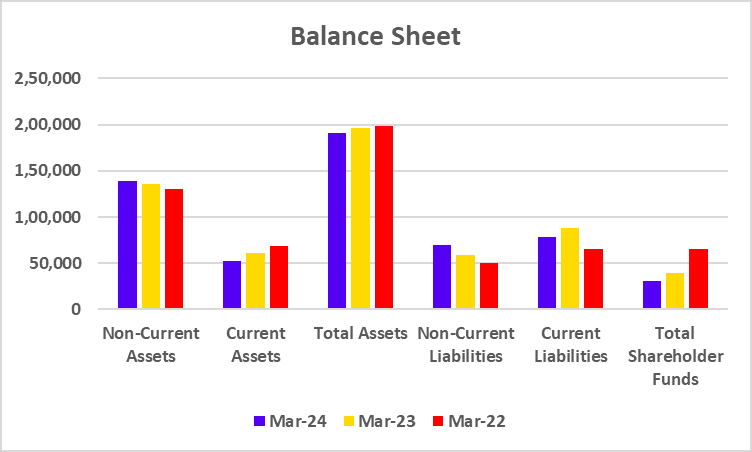

Balance Sheet

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Non-Current Assets | 1,38,883 | 1,35,849 | 1,30,025 |

| Current Assets | 51,924 | 60,507 | 68,575 |

| Total Assets | 1,90,807 | 1,96,356 | 1,98,600 |

| Non-Current Liabilities | 70,075 | 58,901 | 50,181 |

| Current Liabilities | 78,661 | 88,026 | 65,713 |

| Total Shareholder Funds | 30,724 | 39,425 | 65,385 |

Based on the graph, we can conclude that the company’s non-current liabilities have increased over the past three years, whereas its shareholder funds have declined.

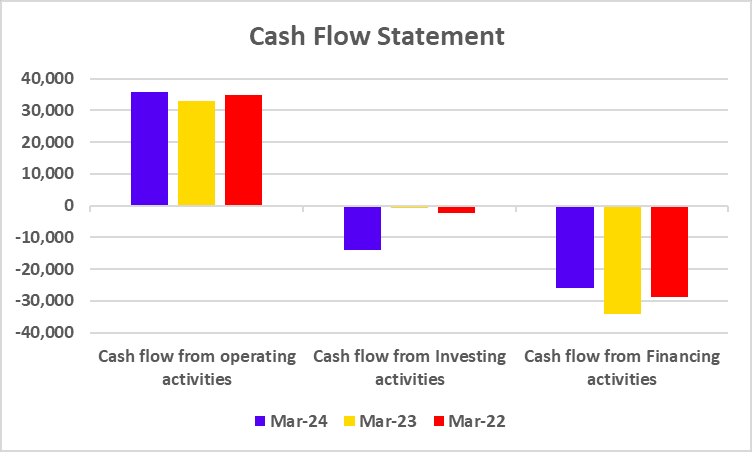

Cash Flow Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Cash flow from operating activities | 35,654 | 33,065 | 34,963 |

| Cash flow from Investing activities | -13,868 | -693 | -2,253 |

| Cash flow from Financing activities | -26,092 | -34,142 | -28,903 |

We may conclude from the above graph that, aside from the company’s cash flow from operations, cash flow from financing and investing is negative.

Key Performance Indicators (KPIs)

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Operating Margin (%) | 18.80 | 18.13 | 29.02 |

| Net Profit Margin (%) | 5.24 | 9.84 | 17.86 |

| ROCE (%) | 24.09 | 24.66 | 28.99 |

| Current Ratio | 0.66 | 0.69 | 1.04 |

| Debt to Equity Ratio | 2.34 | 1.68 | 0.81 |

SWOT Analysis of Vedanta

Strengths

- Product Portfolio – By providing a large selection of commodities to its clients, the business reduces its reliance on a single commodity and increases the stability of its revenue stream.

- Brand Image – Over time, the organization has developed a strong brand image that helps in client acquisition.

- Geographical Reach – Vedanta’s clients are present worldwide, hence mitigating concentration risk.

Weaknesses

- Volatility in Prices – Commodities price fluctuations will immediately affect the company’s profit margin.

- High Debts – Due to ongoing interest payments and restrictions on taking on new projects, the company’s large debt load has a negative impact on its profit.

- Environmental Concern – The business may have to deal with strict government regulations and environmental issues, which could have an effect on how it operates.

Opportunities

- Technological Advancement – Utilizing cutting-edge new technologies in the exploration and production processes will benefit the business by lowering costs and boosting profit margins.

- Renewable Energy – Because there is a growing market for renewable energy, the corporation can move towards clean energy sources.

- Infrastructure Development – India’s infrastructure is expanding at a rapid pace, which may raise demand for products offered by Vedanta.

Threats

- Competition – The mining industry has many participants, and the competition between them will lower the company’s profit margin.

- Economic Condition – Negative economic conditions may decrease Vedanta’s revenues and profit margins.

- Government Policies – The operations of the corporation will be immediately impacted by any policy changes made by the Indian government.

Read Also: Reliance Power Case Study: Business Model, Financial Statements, And SWOT Analysis

Conclusion

In conclusion, Vedanta Limited is a well-known participant in the Indian metal and energy sector. The firm has a wide geographical presence and a broad product range but faces several risks, including heavy debt. Even if the company has a lot of room to grow, an investor should always speak with a financial advisor before making any investment decisions.

FAQs

Who is the founder of Vedanta Limited?

Mr Anil Agarwal is the founder of Vedanta Limited.

Which companies are subsidiaries of Vedanta?

Some of Vedanta’s subsidiary firms are Hindustan Zinc Limited, Bharat Aluminium Company, ESL Steel Limited, Sterlite Technologies Ltd., etc.

Vedanta operates in which countries?

Vedanta operates in India, Namibia, Liberia, and South Africa.

Is Vedanta a profitable company?

The company has been profitable, but its net profits have decreased over the past three years.

What are the products offered by Vedanta Limited?

The company’s main offerings include iron ore, steel, zinc, silver, copper, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.