| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-09-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- vodafone idea case study

Vodafone Idea Case Study: Business Model And SWOT Analysis

If you follow the financial world closely, you have probably heard that Elon Musk is about to acquire Vodafone Idea, the largest telecom business in India. You’ve even heard that the company’s debt is causing problems!

Don’t worry; continue reading the blog, you will get all the answers to your questions.

Vodafone Idea Overview

Vodafone Idea is one of the top telecom service providers in India. The company was established in August 2018 through the merger of Vodafone and Idea, two distinct businesses in the same industry. Of these, Idea Cellular is an Indian telecom provider, and Vodafone India is a division of the British global telecommunications behemoth Vodafone Group.

With 21.98 crore subscribers as of September 2023, the firm ranks third in India for telecom services. The business provides 2G, 3G, and 4G mobile phone and data services.

Business Model of Vodafone Idea

Vodafone Idea provides a broader range of customers with cost-free basic services like incoming calls and broadband connectivity. Additionally, it offers SMS programs that need a membership fee, as well as postpaid and prepaid options.

The business also makes money from value-added services like caller tunes, mobile games, etc., as well as from the cloud data storage services and communication tools they provide to organizations.

Financial Highlights of Vodafone Idea

Let’s have a look at the financials of Voda Idea:

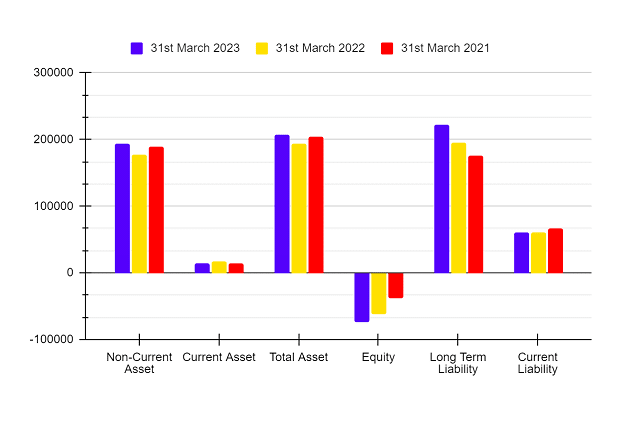

Balance Sheet (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Non-Current Asset | 193,339.80 | 177,193.60 | 189,381.10 |

| Current Asset | 13,902.90 | 16,835.50 | 14,099.50 |

| Total Asset | 207,242.70 | 194,029.10 | 203,480.60 |

| Equity | -74,359.10 | -61,964.80 | -38,228.00 |

| Long Term Liability | 221,579.10 | 194,860.00 | 175,306.10 |

| Current Liability | 60,022.70 | 61,133.90 | 66,402.50 |

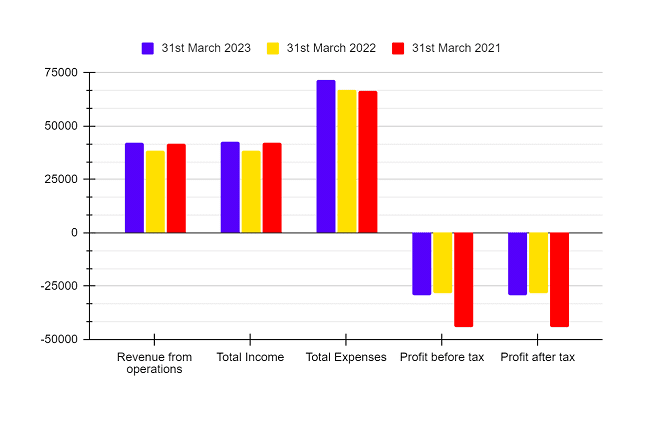

Income Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

| Revenue from operations | 42,177.20 | 38,515.50 | 41,952.20 |

| Total Income | 42,488.50 | 38,644.90 | 42,126.40 |

| Total Expenses | 71,764.20 | 67,044.50 | 66,643.10 |

| Profit before tax | -29,297.60 | -28,234.10 | -44,253.40 |

| Profit after tax | -29,301.10 | -28,245.40 | -44,233.10 |

The company’s operating revenue has increased somewhat, but profit after taxes has been negative during the last three years.

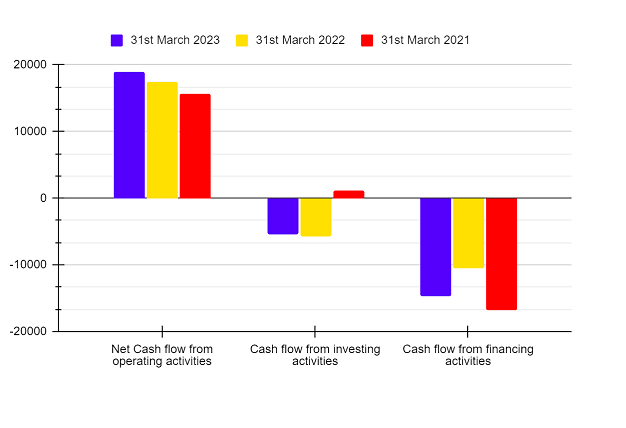

Cash Flow Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Net Cash flow from operating activities | 18,868.70 | 17,387.00 | 15,639.70 |

| Cash flow from investing activities | -5,413.60 | -5,730.30 | 1,075.10 |

| Cash flow from financing activities | -14,679.50 | -10,553.80 | -16,731.40 |

Key Performance Indicators (KPIs)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Operating Profit Margin (%) | -15 | -20 | -16 |

| Net Profit Margin (%) | -69 | -73 | -106 |

| Return on Capital Employed (%) | -4.02 | -5.58 | -4.75 |

| Current Ratio | 0.23 | 0.28 | 0.21 |

| Debt to Equity Ratio | -0.18 | -3.08 | -4.12 |

Read Also: Bharti Airtel Case Study: Services, Financials, Shareholding Pattern, and SWOT Analysis

Follow On Public Offer

Vodafone Idea raised INR 18,000 crores in April 2024 through a follow-on public offering (FPO). The corporation is deeply in debt, and the majority of the amount is due to the government of India.

Telecom businesses must pay license fees to the Department of Telecom for the spectrum they own. Vodafone Idea is under financial strain due to its large debt load and the costs associated with spectrum licenses. Up until October 2023, Vodafone Idea had paid INR 7,854 crores of its INR 58,254 crores in outstanding debt.

So, in February 2024, the board accepted a request to raise INR 20,000 crores. Before the FPO, the company had already raised INR 2,000 crore through preferred shares granted to its promoters.

In FPO, the company allocated 35% of the issuance to retail investors, 15% to non-institutional investors (NIIs), and 50% to qualified institutional buyers (QIBs).

The issue’s pricing range was set at INR 11 on the upper end and INR 10 on the lower end. The issue’s application lot size was fixed at 1,298 shares.

On April 25, 2024, the FPO shares went live on the stock exchanges, i.e., NSE and BSE.

The company intended to set up additional 5G sites and grow their 4G network, therefore, the money raised from the issue will be used to buy equipment to expand their network infrastructure.

Did you know

The FPO launched by Vodafone Idea is the largest FPO so far in India, earlier the biggest FPO was launched by Yes Bank in 2020, which was around INR 15,000 crores.

SWOT Analysis of Vodafone Idea

The Vodafone Idea SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.

Strength

- The company has a large subscriber base of 21.98 crore people, which makes them one of the largest mobile operators in India.

- Vodafone Idea provides its services across the nation, reaching the rural and urban areas.

- The merger of two entities, Vodafone and Idea, increased the strength and customer base, which may assist in tackling the competition.

Weakness

- The company owes a very high debt, which is why they are not able to expand their operations and invest in network upgradation to 5G.

- The Indian telecom industry is highly competitive, and other players like Jio, and Airtel offer aggressive pricing and innovative services.

Opportunities

- With the penetration of data services and smartphones, Vodafone Idea can utilize the opportunity by offering innovative services and data plans.

- The rollout of 5G services acts as a significant opportunity for the company to offer high-speed data connectivity.

- The Indian rural market holds immense potential, and Vodafone Idea can expand its network to increase revenue growth.

Threat

- The debt burden on the company is a major threat as it is not allowing it to expand its current network.

- The Indian telecom industry has intense competition, and various players are offering services in the market; any non-competency by the company will make them lose their market share.

- The regulatory changes made by the government and policies related to spectrum allocation is a major threat to the business model and profit margins.

Conclusion

To sum up, Vodafone Idea is a well-known player in the Indian telecom sector. The company has a creative business plan and is committed to enhancing customer happiness, network performance, and service quality. However, the company’s financial status and other issues are impeding its progress, and to overcome these obstacles, it is concentrating more on network enhancement, customer service, and business alliances.

Frequently Asked Questions (FAQs)

What was the reason behind the merger of Vodafone and Idea?

When Reliance entered the telecom industry with Jio Telecom, Vodafone and Idea strategically merged to counter the challenges of Jio’s entry.

Is Elon Musk buying Vodafone idea?

No, the company has denied the rumours about Elon Musk buying the Vodafone Idea.

Is Vodafone Idea a profit-making company?

No, Vodafone Idea is not a profit-making company. The company has posted losses for the last 3 consecutive years, and the loss for FY 2023 was INR 29,301 crore.

Who is the largest shareholder in Vodafone Idea?

The government of India is the largest shareholder in Vodafone Idea, as they hold about 32.19% of total equity as of March 2024.

What was the issue size of Vodafone Idea’s follow-on public offer?

The issue size of the offer was INR 18,000 crores.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.