| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-09-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- voltas case study

Voltas Case Study: Business Model And Key Insights

Have you noticed the buzz around Voltas lately? Their share price has increased by almost 30% in the April 2024! But what is driving this impressive growth?

In this blog, we will explore the reasons behind Voltas’ success, from strong sales to a recent upgrade by research firms. We will also explore the company’s prospects and what investors must consider before jumping on the bandwagon.

Voltas Company Overview & History

Voltas is a leading Indian multinational home appliances company headquartered in Mumbai, India. Established in 1954, the company designs, develops, manufactures, and sells various products, including air conditioners, refrigerators, washing machines, and microwaves. The company’s major revenue comes from the sale of air conditioners.

The company is a part of the Tata Group, one of India’s largest conglomerates, and has a strong presence in India.

Voltas has a rich history. It was founded as a collaboration between Tata Sons and Volkart Brothers in Mumbai. It partnered with Theckersey Mooljee Group in the early years to market the Ruti Hot Air Sizing Machine. The company has also augmented its portfolio by providing robust mining equipment and establishing a licensing agreement with Carrier Corporation to produce air conditioners.

Voltas’s story is characterized by a persistent trajectory of growth and progression, driven by a strong commitment to meeting customers’ evolving demands and making significant contributions to the landscape of India’s infrastructure and appliance industry.

Did You Know?

Voltas supplied air-conditioning for India’s first fully air-conditioned Ashoka Hotel.

Voltas Business Model

Voltas’s success can be credited to a well-diversified Voltas business model that fulfills to several segments and revenue streams.

The company is divided into three business clusters:

- Electro-Mechanical Projects and Services – This segment undertakes engineering, procurement, and construction projects for domestic and international clients.

- Unitary Cooling Products – Under this segment, the company offers a wide range of products, which includes air conditioners for residential, commercial, and industrial use, air coolers, water coolers, etc.

- Engineering Agency & Services – The company acts as a distributor and service provider for leading equipment manufacturers in various sectors such as textile, construction, etc.

Read Also: Bajaj Auto Case Study: Business Model, Product Portfolio, and SWOT Analysis

Voltas Financial Statements

Voltas Balance Sheet

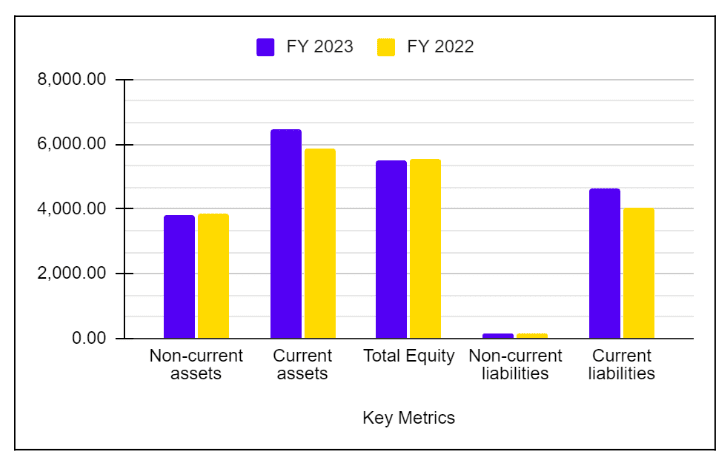

Have a look at the key metrics of the Voltas balance sheet:

| Key Metrics | FY 2023 (INR crore) | FY 2022 (INR crore) |

|---|---|---|

| Non-current Assets | 3,832.52 | 3,867.11 |

| Current Assets | 6,446.49 | 5,879.22 |

| Total Equity | 5,493.72 | 5,537.64 |

| Non-current Liabilities | 165.75 | 152.78 |

| Current Liabilities | 4,619.54 | 4,055.91 |

Income Statement

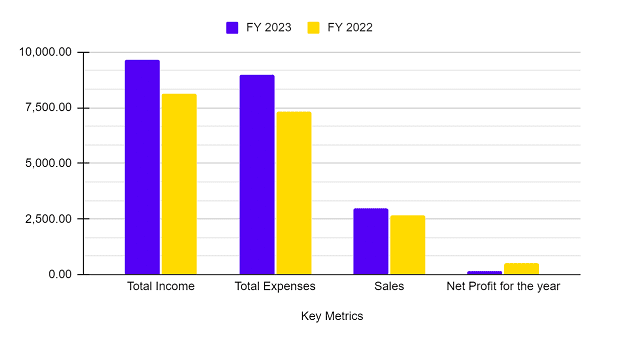

| Key Metrics | FY 2023 (INR crores) | FY 2022 (INR crores) |

|---|---|---|

| Total Income | 9,667.22 | 8,123.64 |

| Total Expenses | 8,995.61 | 7,316.03 |

| Sales | 2,957 | 2,667 |

| Net Profit for the year | 136.22 | 506 |

Key Insights of Financial Statements

The company’s recent financial performance has been mixed. The consolidated net profit significantly declined by 73% in FY 2023. Overall, the revenue growth over the past year has been modest, but signs of improvement were seen in FY 2023.

Voltas sold a staggering 2 million AC units during the fiscal year 2023-24, a record-breaking sales performance that solidified the company’s position as the top-selling AC brand in India for a single financial year.

In a recent business update, the company stated that sales in the AC segment have shown a volume growth of 35%.

The Indian residential AC market is estimated to reach approximately 10 million units by FY 2024, with a projected growth of 11.5 million units.

During the March quarter, when sales of compressor-based cooling products generally increased due to favourable temperatures, Voltas reported substantial volume growth of 72% in sale of air conditioners during Q4 of FY 23-24.

Additionally, UBS’s (a global brokerage firm) published a buy report on Voltas in April 2024, which has been a major contributor to the 30% surge in the company’s share price.

Key highlights from the UBS Report:

- UBS has upgraded the recommendation of Voltas share from neutral to buy, stating the growth prospects of sales in the coming quarters because of heat waves and rising temperatures.

- Voltas’s target price was raised from INR 885 to INR 1800, which signifies the anticipation of a substantially elevated share price in the near future.

- The revised price target suggests a potential upside of 20% in Voltas’s share from current levels (Current Price – INR 1480 as of 30 April 2024) and values the cooling segment at 55 times the earnings for the next 12 months, compared to the previous multiple of 35 times and the five-year average of 45 times.

The report highlights certain factors contributing to their optimistic perspective on Voltas. UBS contends that the company is witnessing robust sales growth, especially in its air conditioner segment.

The brokerage firm also emphasizes the advantages of Voltas’ joint venture with Arcelik, a prominent Turkish appliance manufacturer, and that it is expected to boost the market share and profitability.

However, remember that UBS previously downgraded Voltas in June 2023, citing concerns about their declining market share and margins. Further, Brokerage firms have the option to change their current stance later on if they find any anomalies.

Voltas Growth Prospects

Voltas, a prominent air conditioner company in India, is strategically positioned to exploit the increasing need for cooling solutions in a warm climate. The rising disposable incomes and increasing urbanization in India are expected to contribute to a further increase in this demand.

In addition to air conditioners, Voltas presents a wide array of household appliances, encompassing refrigerators, washing machines, and water purifiers. This diversification of products mitigates risks and offers prospects for expansion in previously untapped market segments.

Read Also: Bandhan Bank Case Study: Business Model, Financial Statement, SWOT Analysis

Conclusion

In summation, Voltas’ recent performance has been impressive. With a 30% surge in share price in April 2024 and strong sales figures, the company appears to be on a strong growth trajectory. The company’s prospects are promising, but investors should know about the competitive landscape and economic challenges. Further, it is suggested that you do a thorough analysis and consult with your financial advisor before investing in the company.

FAQs

What is voltas?

Voltas is an Indian multinational company, part of the Tata Group, known for air conditioners, home appliances, and engineering services.

Voltas business is divided in how many segments?

Voltas’ business is divided into three segments: Electro-Mechanical Projects and Services, Unitary Cooling Products, and Engineering Agency & Services.

What products do Voltas sell?

Voltas offers AC, refrigerators, washing machines, water purifiers, and other home appliances

Is Voltas a good investment?

The company’s future looks promising, but it is crucial to do thorough research before investing.

What are some critical challenges for Voltas in the coming future?

Voltas face tough competition from other appliance brands such as Lloyd, Blue Star, etc. and is susceptible to economic fluctuations.

Is Voltas a part of the Tata Group?

Yes, Voltas is a part of the Tata Group. As of March 2024, approximately 30% of the company is owned by Tata Sons, the parent Company of the TATA Group.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.