| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-23-24 | |

| Post updated | Pocketful Team | Oct-23-24 | |

| Post updated | Pocketful Team | Oct-23-24 | |

| Post updated | Pocketful Team | Oct-23-24 | |

| Added new content an formatted it | Ranjeet Kumar | Oct-24-24 | |

| Post updated | Pocketful Team | Oct-24-24 | |

| Added new Links In it | Unknown Author | Oct-24-24 | |

| Post updated | Pocketful Team | Oct-24-24 | |

| added new image | Ranjeet Kumar | Oct-24-24 | |

| Add new links | Nisha | Apr-14-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- waaree energies case study

Waaree Energies Case Study: Business Model, Financial Statements, And SWOT Analysis

Waaree Energies Limited is a leading name in India’s renewable energy sector, especially in solar energy. With more than 30 years of expertise, the company has established itself as one of the leading manufacturers of solar PV modules, achieving a remarkable installed production capacity of 12GW and an international presence across 68 countries. Amid the global transition to sustainable energy solutions, Waaree stands out with its impressive array of products, including solar modules, inverters, and energy storage systems, making it a leader in this transition to renewable energy.

In this blog, we will discuss the business model of Waaree Energies, do a SWOT analysis, and see how the company has evolved financially over the years within the rapidly evolving energy sector.

Waaree Energies Company Overview

Waaree Energies stands out as a premier Indian manufacturer and exporter of solar modules. Founded in 1990, the company is now one of the largest solar module manufacturers globally. Waaree has established itself as a market leader in the solar industry by prioritising the delivery of high-quality, cost-effective, sustainable energy solutions.

In 1990, Anmol Fluid Connectors Private Limited was established in Mumbai, India. In 2007, the company rebranded itself as Waaree Solar Private Limited and shifted its focus towards the production of solar PV modules. In 2013, it became a public limited company. Currently, it has five solar manufacturing plants in India and operates in more than 68 countries worldwide.

Business Model & Services of Waaree Energies

Waaree Energies’ business model focuses on manufacturing high-quality solar PV modules, offering a diverse solar energy portfolio that includes multicrystalline, monocrystalline, and TopCon (Tunnel Oxide Passivated Contact) modules. Additionally, the company provides flexible options such as bifacial modules (Mono PERC) and BIPV modules, catering to a wide range of renewable energy needs.

Alongside solar modules, Waaree excels in the manufacturing and distribution of solar inverters. These innovative devices transform the Direct Current generated by solar panels into Alternating Current (AC), making it suitable for use in both residential and commercial settings.

The company’s sales channels are as follows,

- Direct Sales to utilities and Enterprises

- Export Sales of Solar PV Modules and EPC services

- Retail Sales through franchisees for rooftop and MSME customers.

Other sources of revenue are from EPC services, O&M, ancillary products, export incentives, renewable electricity generation, and scrap sales.

Waaree also plans to expand by regularly increasing capacity and upgrading manufacturing technology, focusing on Mono PERC, large silicon wafer tech, and emerging technologies like TopCon.

Read Also: Suzlon Energy Case Study: Business Model, Financial Statement, SWOT Analysis

SWOT Analysis of Waaree Energies

Strengths

- Market Leader: As India’s leading solar PV module manufacturer, the company is strategically positioned to leverage the industry’s momentum and capitalise on the growth opportunities for solar energy, both domestically and worldwide.

- Multiple Revenue Sources: Waaree provides a comprehensive selection of solar solutions featuring high-quality solar modules, efficient inverters, advanced energy storage systems, and reliable solar water pumps. This diversification effectively reduces risks tied to relying on a single product segment.

- Export Business: The company has a remarkable export business, providing solar modules to more than 68 countries and establishing itself as a significant player in the global market and India.

Weaknesses

- Dependent on Suppliers: While Waaree stands out as a leader in module manufacturing, it lacks the level of backward integration into solar cell production that some of its competitors possess. This gap may lead to greater dependence on external suppliers.

- Capital Intensive Business: Manufacturing solar modules requires a high capital investment, and elevated operating costs can reduce profitability in a highly competitive and price-sensitive market.

- Regulatory Impact: As with many renewable companies, Waaree relies heavily on supportive government policies and subsidies. A decrease in these incentives could greatly affect its profitability and hinder its growth opportunities.

Opportunities

- Increase in Demand: Demand for solar energy is increasing because of the growing emphasis on renewable energy and sustainability in response to climate change. The company is strongly poised to take advantage of this emerging trend.

- Technological Advancement: With the continuous evolution of technology in the solar industry, exciting opportunities exist to create more efficient and cost-effective products. The company’s research and development efforts may result in breakthroughs that give them a competitive edge.

- Export Opportunities: Waaree can increase its export business and lessen its dependence on the Indian market by expanding globally and entering emerging markets.

Threats

- Regulatory Changes: The solar energy sector relies heavily on government policies. Government policies are vital in shaping solar module manufacturing in India. Despite government support, the policy framework is unstable due to frequent changes, conflicting priorities, poor design, and lack of coordination among government bodies.

- Competition: Solar PV manufacturing is progressing towards producing more efficient and affordable modules. Solar technology changes can shift demand to newer products, making existing inventory less desirable. Most know-how and manufacturing for new PV cells and modules comes from China, posing challenges in maintaining quality and keeping up with rapid advancements.

Read Also: Havells Case Study: Business Model and SWOT Analysis

Waaree Energies IPO Details

| Table of Content | Details |

|---|---|

| IPO Date | 21 October 2024 to 23 October 2024 |

| Price Band | ₹1,427 to ₹1,503 per share |

| Lot Size | 9 Shares |

| Total Issue Size | 28,752,095 shares |

| Fresh Issue | 23,952,095 shares |

| Offer for Sale | 4,800,000 shares |

| Listing Date | 28 October 2024 |

Lot Size of Waaree Energies

| Application | Lots | Amount |

|---|---|---|

| Retail (Minimum) | 1 Lot/9 shares | ₹ 13,527 |

| Retail (Max) | 14 Lots/126 Shares | ₹ 1,89,378 |

| S-HNI (Min) | 15 Lots/135 Shares | ₹ 2,02,905 |

| S-HNI (Max) | 73 Lots/657 Shares | ₹ 9,87,471 |

| B-HNI (Min) | 74 Lots/666 Shares | ₹ 10,00,998 |

Read Also: Ather Energy Case Study: Business Model, Financials, and SWOT Analysis

Financial Information of Waaree Energies

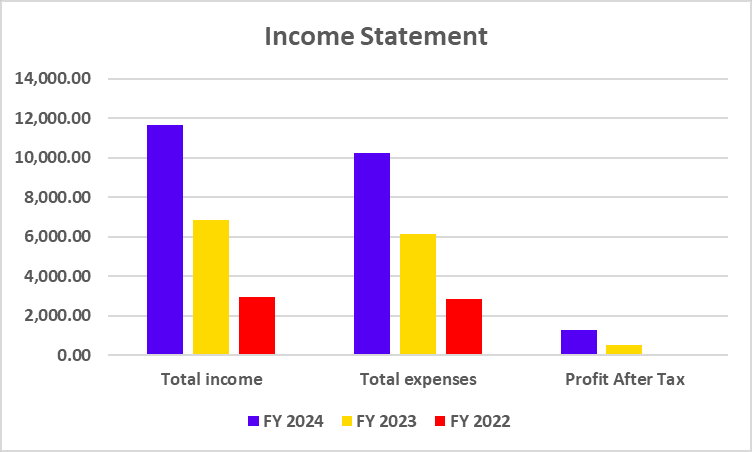

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total income | 11,632.76 | 6,860.36 | 2,945.85 |

| Total expenses | 10,239.90 | 6,162.63 | 2,827.47 |

| Profit After Tax | 1,274.37 | 500.27 | 79.65 |

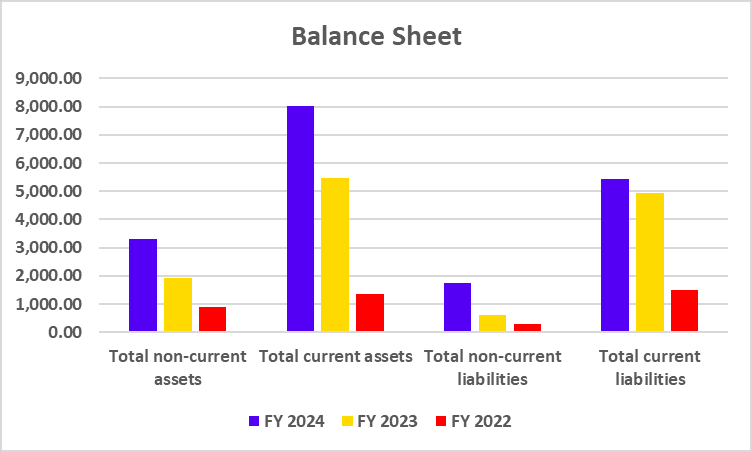

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total non-current assets | 3,300.64 | 1,936.97 | 893.23 |

| Total current assets | 8,013.08 | 5,482.94 | 1,344.16 |

| Total non-current liabilities | 1,742.09 | 628.83 | 299.91 |

| Total current liabilities | 5,423.14 | 4,929.23 | 1,497.63 |

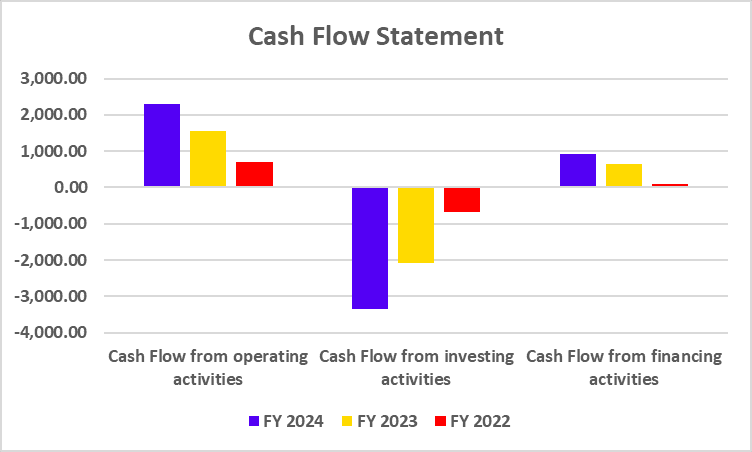

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from operating activities | 2,305.02 | 1,560.22 | 700.85 |

| Cash Flow from investing activities | -3,340.25 | -2,093.82 | -674.85 |

| Cash Flow from financing activities | 909.18 | 642.47 | 98.51 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| EBITDA Margin | 15.56% | 13.76% | 6.88% |

| PAT Margin | 10.96% | 7.29% | 2.70% |

| Debt to Equity Ratio | 0.08 | 0.15 | 0.72 |

| ROE | 30.26% | 26.26% | 17.69% |

| ROCE | 26.29% | 31.61% | 21.89% |

Read Also: Zaggle Case Study: Business Model, Financials, and SWOT Analysis

Conclusion

Waaree Energies is a key player in the renewable energy sector and is known for its renewable energy products, strong brand, and global reach. The increasing demand for clean energy, government support, and new technology provides the company significant growth opportunities. Nonetheless, the company must confront several challenges, including intense competition, fluctuations in raw material prices, and a dependence on regulatory changes. Waaree can grow sustainably in the expanding renewable energy market by investing in innovation, diversifying its portfolio, and expanding globally.

Frequently Asked Questions (FAQs)

What is Waaree Energies known for?

It is known for being one of India’s largest solar PV module manufacturers, specialising in solar energy products like PV modules, inverters, and energy storage systems.

Does Waaree Energies export to other countries?

The company exports its products to over 68 countries, establishing a strong international presence.

What does Waaree Energies do?

Waaree Energies is a solar energy company that manufactures solar panels and provides solar solutions like EPC services, rooftop systems, and solar water heaters.

How does Waaree Energies benefit from government policies?

Waaree benefits from government initiatives like the National Solar Mission and ‘Make in India’, which promote renewable energy and domestic manufacturing.

How does Waaree Energies handle competition in the solar market?

Waaree competes by leveraging its manufacturing capacity, quality products, and R&D to stay ahead in the competitive solar energy market.

Should I invest in the Waaree Energies IPO?

Investing in the Waaree Energies IPO needs careful consideration of the company’s strengths, market position, and the overall growth prospects of the renewable energy sector. Eventually, the decision to invest in the IPO depends on individual preference and investment horizon. You must consult a financial expert before investing.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle