| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-19-24 | |

| Add new links | Nisha | Mar-20-25 |

- Blog

- what are bond yields

What are Bond Yields?

Bonds are the most preferred low-risk investment option, so it’s crucial to include them into your portfolio. One of the critical features to look at while investing in bonds is the bond yield.

In this article, we will learn about bond yields as a return on investment.

What are Bonds?

Bonds are fixed-income investment instruments that corporations or governments issue to collect money from investors. These institutions borrow the funds at a fixed interest rate for a defined period to finance their projects and activities.

What is Bond Yield?

Bond yield is the rate of return or interest earned by investing in a bond. It measures the profitability of the bond investment for the investor. Bond Yields help investors compare the attractiveness of different bonds and make informed investment decisions. The overall demand and supply of bonds in the market can influence yields. High demand for bonds usually lowers yields, while low demand can increase them.

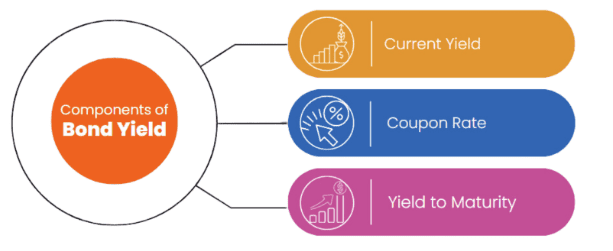

3 Significant Components of Bond Yield

1. Current Yield

Current Yield is a financial metric that shows the annual return generated on an investment. It is calculated by dividing the bond’s annual interest payment by its current market price. It is generally expressed as a percentage of the bond’s market price.

Calculation of Current Yield:

Current Yield = ( Annual Coupon Payment / Market Price ) × 100

2. Coupon Rate

Unlike the current yield, a coupon rate is the nominal annual rate of interest that a bond pays during the bond’s duration. For example, you can purchase a 10-year bond with a face value of ₹ 100 and a coupon rate of 5%. Every year, the bond will pay you 5% of its value, or ₹ 5, until it expires in a decade.

Calculation of Coupon Yield:

Coupon Yield = ( Annual Coupon Payment / Face Value ) × 100

3. Yield to Maturity (YTM)

A yield to maturity is the total return earned on bonds until maturity. It is also referred to as the redemption yield or long-term bond profit. YTM is calculated annually and assumes that the investor will reinvest each interest payment at the same rate until maturity.

It is the rate at which all the future cash flows are discounted to arrive at the current market price.

The calculation of Yield to Maturity (YTM) is an iterative process and is generally done via hit and trial method.

Factors That Affect Bond Yields

- Interest Rates: Bond prices and yields have an inverse relationship. When interest rates rise, bond prices fall, leading to higher yields and vice versa.

- Credit Risk: The issuer’s creditworthiness affects yields. Higher credit risk (lower credit rating) demands higher yields to compensate investors for the increased risk.

- Inflation: Higher inflation expectations typically lead to higher yields, as investors demand greater returns to offset the erosion of purchasing power.

- Market Demand and Supply: The overall demand and supply of bonds in the market can influence yields. High demand for bonds usually lowers yields, while low demand can increase them.

Read Also: Detailed Guide on Bond Investing: Characteristics, Types, and Factors Explained

Bond Yield Curve

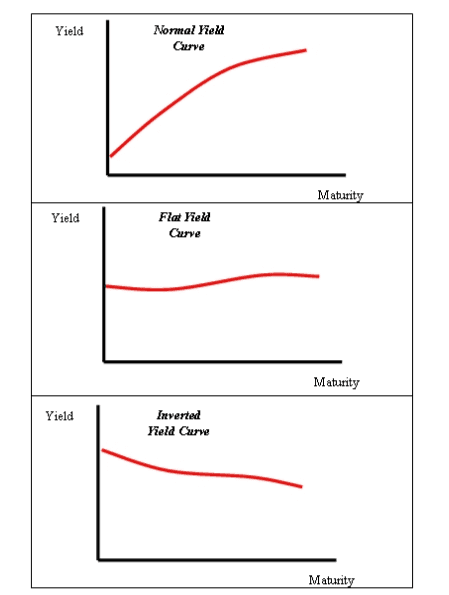

A bond yield curve is a graph that shows the interest rates, or yields, of bonds with the same credit quality but different maturity dates. The yield curve’s slope can indicate future interest rate changes and economic trends.

Did you know?

As of March 24, the 10-year benchmark bond yield was around 7.04%, while the five-year and seven-year bond yields were around 7.05%, leading to a mild inversion in the bond yield curve.

Three basic types of Yield Curve are:

1. Normal Yield Curve

A normal yield curve, or an upward-sloping yield curve, occurs when longer-term bonds have higher yields than shorter-term bonds. Investors expect future economic growth and possibly higher inflation, leading to higher interest rates. It is typical in a healthy, growing economy where long-term investments carry more risk, thus requiring higher returns.

2. Flat / Humped Yield Curve

A flat yield curve occurs when short-term and long-term bonds have similar yields. A humped yield curve is a variation where medium-term bonds have higher yields than both short-term and long-term bonds.

A flat yield curve suggests uncertainty about future economic conditions. It can indicate a transition period in the economy, such as moving from growth to recession or vice versa. A humped yield curve may suggest that the market expects moderate interest rate changes in the future.

3. Inverted Yield Curve

An inverted yield curve, or downward-sloping yield curve, happens when shorter-term bonds have higher yields than longer-term bonds. It indicates that investors expect future interest rates to fall, often due to an anticipated economic slowdown or recession. An inverted yield curve is a strong predictor of financial downturns as investors flock towards the safety of long-term bonds, thus reducing its yield.

Tax Implication on Bond Yields

When an investor sells bonds in the secondary market and makes a profit, it is called capital gain. The tax payable on this gain depends on the type of bond and how long it was held.

A. Listed Bonds:

- Held for 12 months or less: Short-term capital gains tax at applicable slab rates.

- Held for over 12 months: Long-term capital gains tax at 10% (non-indexed).

B. Unlisted Bonds:

- Held for 36 months or less: Short-term capital gains tax at applicable slab rates.

- Held for over 36 months: Long-term capital gains tax at 20% (non-indexed).

C. Tax-Free Bond Investments

- Some Bonds do not attract any tax and are considered ‘tax-free’. These bonds exist under section 54EC and are issued by the government. They do not attract any tax liability upto ₹ 20,000. Sovereign gold bonds are also exempt from tax liability under certain limitations.

Read Also: What Is Bowie Bond (Music Bonds) : History, Features, Advantages & Disadvantages

Conclusion

Investing in bonds is a good strategy when aiming for stable returns and lower risk than equities. However, it’s crucial to be aware of certain factors to maximize your investment benefits and minimize potential drawbacks. Remember to always evaluate the interest rates offered by different bonds and how the income is taxed. The creditworthiness of the bond issuer is crucial. Higher yields may come with higher risks, so assessing the issuer’s financial stability is essential.

By carefully considering these aspects, you can make informed decisions and strategically invest in bonds to enhance your portfolios while ensuring tax efficiency and capital safety.

Frequently Asked Questions (FAQs)

What factors determine the yield on government bonds in India?

The yield on government bonds in India is determined by market demand and supply, interest rates set by the Reserve Bank of India (RBI), and the overall economic conditions.

Why do government bond yields act as a benchmark for other interest rates in India?

Government bond yields are considered risk-free and reflect the government’s borrowing cost. They serve as a benchmark for setting interest rates on other loans and securities in the market.

How do I invest in Bonds?

Government bonds in India can be purchased directly from the RBI Retail Website. Corporate bond investments can be made through a financial institution or trusted broker. ETFs and other mutual funds are also a good option for investing in bonds in India.

What is the significance of the yield curve in the Indian financial market?

The yield curve represents the yields of bonds of different maturities. A normal upward-sloping yield curve indicates healthy economic growth, while an inverted curve may signal a potential recession.

What are the risks involved in investing in G-Sec bonds?

G-sec are generally referred to as risk-free instruments, as sovereigns rarely default on their payments. However, market, liquidity, and reinvestment risks exist even in G-sec bonds.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.