| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-12-23 | |

| Update Keyword | Nisha | Mar-20-25 |

- Blog

- what are etfs are etfs good for beginner investors

What are ETFs? Are ETFs good for beginner investors?

Recently, Exchange Traded Funds abbreviated as ETFs have gained popularity among investors. For the various benefits they offer. ETFs are a good investment option for beginner investors as they offer a collection of stocks with similar characteristics in one place. Investing in ETFs enables investors to have a diversified portfolio without doing research for individual stocks. ETF helps to minimise the risk of the investor & maximise his return on his portfolio.

By the time you finish reading this article. You will have a clear idea of whether you should invest in ETFs or not.

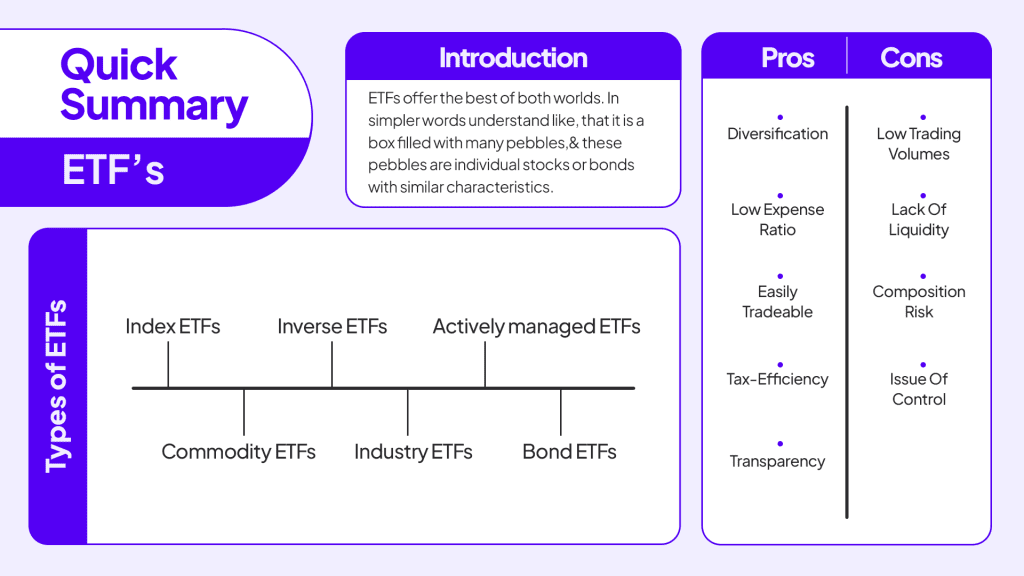

What are ETFs or Exchange- Traded Funds?

In simpler words understand like, that it is a box filled with many pebbles,& these pebbles are individual stocks or bonds with similar characteristics. An interesting fact is that specific ETFs track the movement of indices like NIFTY50, SENSEX, etc. So, you expect the same returns on your investment as the index’s annual CAGR.

Looking into the history of ETFs in India, we see that. The first ETF in India was launched in 2002 by Nippon India Mutual Fund (erstwhile Benchmark Asset Management Company Ltd). Listed on January 8th 2002, it witnessed a trading of 1.30 crores on the first day. The journey to listing of the 100th ETF on NSE took more than 19 years. The last one-year period has seen a lot of activity in the ETF space, with 21 ETFs getting listed on the NSE. The assets under management of ETFs in India are now at Rs. 3.16 lakh crores (end of May 2021), witnessing more than 13.8 times increase in five years, compared to Rs. 23,000 crores (end of April 2016).

ETFs offer the best of both worlds, like Mutual Funds, ETFs represent professionally managed collections or baskets of stocks or bonds. And just like individual stocks, they trade on the stock exchanges, which means you can buy and sell them like individual stocks.

Types of ETFs

- Index ETFs:

These ETFs track a particular index, like in the case of India, it could be NIFTY50, SENSEX etc. - Commodity ETFs:

Designed to track the price of a particular commodity like gold, oil, etc. - Inverse ETFs:

When the market value of the underlying asset decreases or declines, these ETFs make a profit. - Actively managed ETFs:

These ETFs outperform the index. Contrary to most ETFs, which track an Index. - Industry ETFs:

These ETFs provide exposure to a specific field or industry, e.g. automobile, healthcare etc. - Bond ETFs:

ETFs that track the movement of the bonds are called Bond ETFs. It provides exposure to every virtual bond present in the market.

Investing in ETFs comes with its own set of pros and cons.

What are the pros of investing in ETF?

Investing in ETF has several benefits, some of which are listed below.

1. Diversification:

ETFs enable the investor to diversify their portfolio without the hassle of individually picking out each stock. Investors seeking to invest in a specific type of sector or industry. ETFs are a go-to option for people who do not want to spend their time researching each company individually. They cover most of the asset classes and sectors for the most part.

2. Low expense ratio:

The expense ratio is the operating expense of the Security, divided by the value of that security. In other words, it is the expense that the investor has to bear for the Security. An expense ratio below 1 is good. And ETFs offer an expense ratio below 1.

3. Easily tradeable:

Investors can trade ETFs just like individual stocks, which makes them highly liquid, meaning you can sell and buy them anytime during market hours.

4. Tax-efficiency:

Due to its low turnover, ETF offers tax relief to investors. The investors are charged 15% on short-term equity gains. And 10% on long-term equity hains after the exemption of the first 1 lakh rupees.

5. Transparency:

ETFs typically have the same securities as the index or the benchmark they track. Some ETFs disclose their holdings regularly, while others disclose them on a monthly, or quarterly basis.

What are the cons of investing in ETFs?

Investing in ETF has several disadvantages, some of which are listed below.

1. Low trading volumes:

Even though ETFs have become popular lately, their trading volume is considerably low compared to the other securities listed. Volume is the total buying and selling of a specific security over the trading exchange.

2. Lack of liquidity:

Due to low trading volume, sometimes it becomes hard to sell the ETFs because there is no one willing in the market to buy them at the price you are offering at that time. Therefore, ETFs are not the most liquid asset to hold.

3. Composition risk:

Since ETFs are already tailored-made investment options. Sometimes, they may have some securities in the group that you do not want to hold. Therefore, you do not have a choice for customisation.

4. Issue of control:

ETFs offer less control as the investor does not choose the securities in the ETF by his own will. Also, the portfolio manager swaps or churns the portfolio depending on his expertise.

Points to keep in mind before investing in ETFs

- First, determine the assets, in which you want to invest. Choose the best possible ETF according to your risk appetite and availability of funds.

- Go for those ETFs that offer a low expense ratio. So, you can save on your operating costs.

- Invest in ETFs with high liquidity so you can sell them without any hassle whenever you want. Otherwise, it would be a hectic task.

- Check the ETF disclosure reports to ensure that your financial goals align with the objectives of that particular ETF.

- Lastly, regularly check the performance of the ETFs and take the required measures according.

Read Also: What is Nifty BeES ETF? Features, Benefits & How to Invest?

Conclusion

From the above article, we can conclude that, as a beginner investor, ETFs could be an adequate option to start your investing journey. Keep in mind that everything has pros and cons & the same applies to ETFs. Keeping a check on a few things and investing with patience and discipline can yield lofty returns for investors.

FAQs (Frequently Asked Questions)

What are ETFs in the stock market?

ETFs or exchange-traded funds are financial securities that resemble the characteristics of both Mutual Funds and Stocks. In simpler words, a collection of different stocks to track the performance of a specified index.

How do ETFs work?

ETFs are like common stocks on the stock exchanges. They track the movement of the underlying asset and perform accordingly.

What are the types of ETFs?

Different types of ETFs are present in the market like index ETFs, sector ETFs, and commodity ETFs.

Which are the best-performing ETFs in India?

Kotak PSU Bank ETF, CPSE Exchange Traded Fund, UTI S&P BSE Sensex ETFETF are the top-performing ETF funds for the past year.

What are CPSE ETFs?

CPSE ETF (Central Public Sector Enterprises Exchange-Traded Fund). An investment instrument that allows you to invest in Central Government public sector enterprise.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.