| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-04-23 | |

| Add new links | Nisha | Mar-20-25 |

Read Next

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

- List of Best Commodity ETFs in India

- Bullish Options Trading Strategies Explained for Beginners

- Best Brokers Offering Free Trading APIs in India

- Top Discount Brokers in India

- Best Charting Software for Trading in India

- Benefits of Intraday Trading

- What are Exchange Traded Derivatives?

- What is Margin Shortfall?

- What is Central Pivot Range (CPR) In Trading?

- Benefits of Algo Trading in India

- Blog

- what are the challenges traders face when trading in the stock market

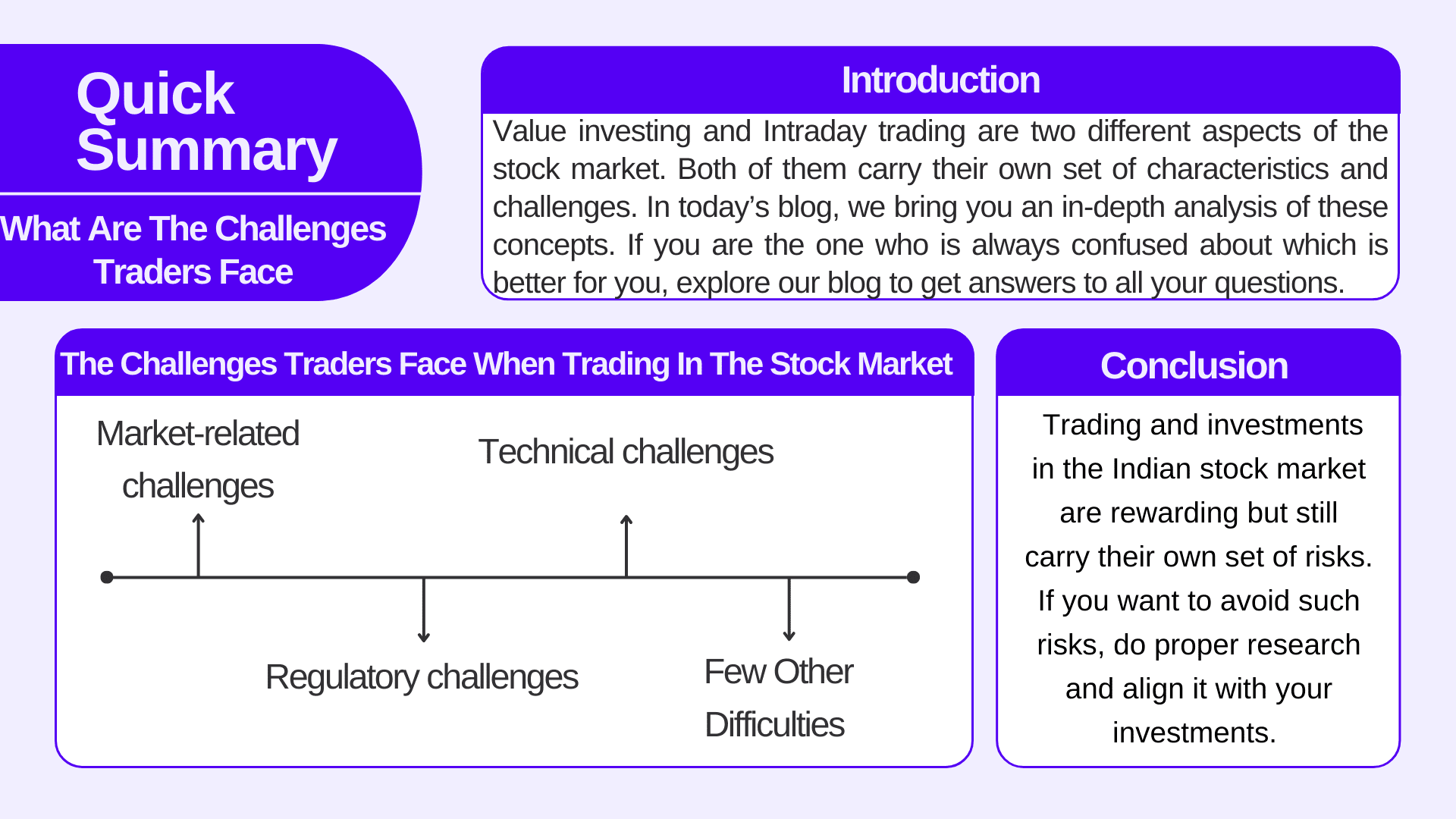

What Are The Challenges Traders Face When Trading In The Stock Market?

The stock market is dynamic, and traders face a range of challenges even though the Indian market carries unique characteristics that help them function accurately. The market offers an opportunity to earn higher returns, but with some bitter challenges. Traders should be aware of such challenges.

Difficulties are common in a country like India, where financial literacy is 27%, implying that only one out of every five people understands finances and how to manage them. People in India trade not only to manage their finances but also because they are afraid of missing out. Investors and traders who are aware of market risks do not attempt to build curated portfolios based on their risk tolerance; instead, they invest in a basket of stocks with an overexposure to micro-cap companies for quick gains.

In this blog, we shall be discussing the biggest challenges that traders face while trading in the Indian markets.

Challenges in the stock market can be classified into three main categories:

- Market-related challenges

- Regulatory challenges

- Technical challenges

Below is a detailed explanation of these three challenges.

Market-Related Challenges

- Volatility in the stock market

We all know that markets, be they Indian or global, can be highly volatile and fluctuating. These fluctuations are unpredictable and can be rapid, thereby creating a risk for intra-day as well as positional traders. - Lack of Liquidity

Some stocks have lower volumes when compared to other stocks, which makes it difficult for the trader to create a position in such stocks at the desired prices. - Asymmetric Information

Traders in India compete in an environment where information is skewed. The flow of information in the Indian market is asymmetric, meaning that there is an imbalance in the information that the buyer and the seller have. Institutional traders and retail traders may not have equal access to market-moving information, which can create disparities in trading strategies.

Regulatory Challenges

- Complex Framework

The regulatory framework of the Indian stock market is complex and can be challenging to comply with, and this includes regulations from SEBI (Securities & Exchange Board of India). Although SEBI has been doing a really good job protecting market participants. - High Transaction Cost

Costs such as brokerage and security transaction tax (STT) are generally high, especially in the case of derivatives trading, which can significantly impact the realised profit. Check out our blog on different types of charges in online trading. - Compliance

Traders need to be aware of tax regulations, including capital gains tax, and ensure proper compliance. Tax implications can hamper trading decisions and profitability. - Limit Imposed on Foreign Investments

International investors or traders may find it difficult to invest in Indian businesses because of certain restrictions imposed by the RBI. The upper limit of overall investment for FII (Foreign Institutional Investors) in any particular Indian company is 10%, subject to the overall limit of 24% on investments by all FIIs and NRIs (Non-Resident Indian). It can only be changed if suggested by the concerned authority.

Technology-based Challenges

- Internet issues

It becomes challenging for people who reside in rural areas to trade. Connectivity issues can disrupt trading during market hours and lead to unnecessary delays in the execution of trades. At times, advanced trading platforms might not be accessible to these traders. - Cybercrime

Cybersecurity threats, such as hacking and fraud, are a concern for online traders since these are very common. - Broker-related tech issues

At times, while trading in the stock market, the trading platforms may not function smoothly, and trades get stuck in between, which could result in losses for the traders. Even the most tech-savvy brokers in India are not immune to this.

Read Also: Trading For Beginners: 5 Things Every Trader Should Know

A few other difficulties that a trader can face while buying or selling in the Indian stock market.

- The psychological aspect of trading is that people unwillingly involve themselves in emotional trading. This happens because of a lack of discipline and proper education. They don’t make logical and informed trading decisions, and then eventually they are trapped in the wrong trades.

- Due to a lack of information and literacy in India, traders frequently rely on advice and tips given to them by others. This could be disastrous because it is easy to follow others, but for managing and exiting on time, your own expertise is needed.

- It is difficult for traders to trade in the market if they do not analyze the risks involved and do not practice proper risk management.

Also, check out our blog- Top 10 Highest Leverage Brokers in India

Conclusion

To conclude, trading and investments in the Indian stock market are rewarding but still carry their own set of risks. If you want to avoid such risks, do proper research and align it with your investments. Start trading with a small amount and increase the capital invested gradually over time.

Remember that trading is a zero-sum game, which means that your loss is someone else’s gain or vice versa. Even after gaining a wealth of knowledge, proper execution, risk management, patience, and perseverance are required. Despite these challenges, the Indian market provides traders with appealing opportunities.

FAQs (Frequently Answered Questions)

Are there psychology-related challenges in India?

Yes, traders in India do trade with emotions like fear and greed.

How do global market conditions pose a challenge to the Indian economy?

Various economic conditions and geopolitical events can affect the Indian market.

Is liquidity the same across sectors?

No, liquidity varies across different instruments because of various factors involved in it.

Who frames the regulations of the stock market in India?

SEBI (Securities & Exchange Board of India) regulates Indian stock market.

Can broker-related technical risk be eliminated?

One can reduce this risk to a certain extent by opening accounts with other brokers.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle