| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-28-23 | |

| Add new links | Nisha | Mar-20-25 |

- Blog

- what is a good rule for investing in stocks

What is a good rule for investing in stocks?

When talking about investing nearly all of us know this simple and yet the most important rule of investing, i.e. ‘Buy low, sell high’. And yet it is not like we all are Warren Buffet.

According to statistics, only 1% of people make money in stock markets. Did you ever wonder what this 1% of people have done right in the markets?

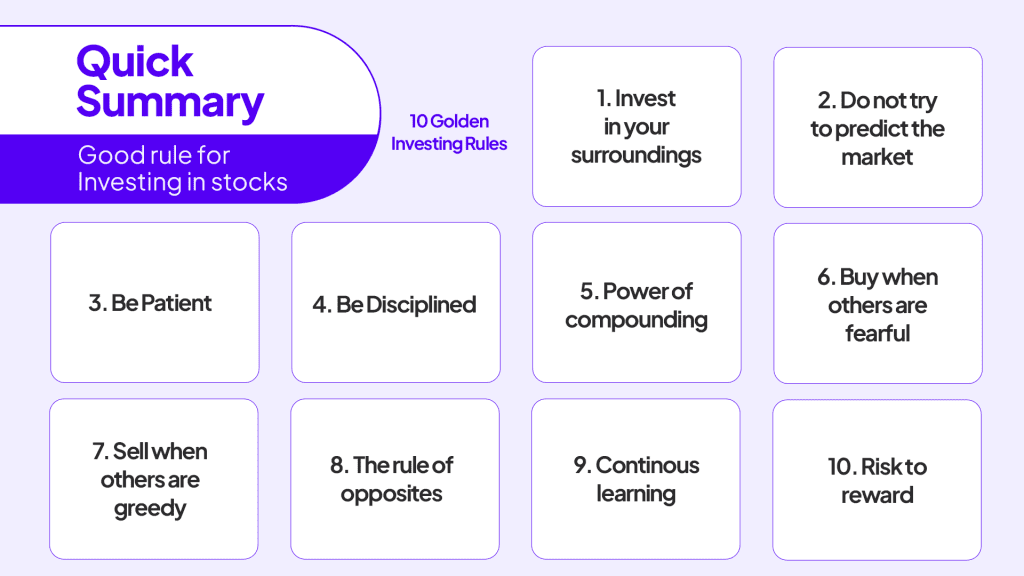

After intensive research, we have shortlisted 10 such findings that were common among the top 1% of the investors. Which can be your ultimate guide to start your investing journey in the stock market.

10 golden investing rules that every investor should keep in mind:

1. Invest in your surroundings-

The first and foremost rule in investing that every investor must abide by is, to invest in the companies they understand and know about their business.

Even coined by one of the most successful investors of all time Mr. Warren Buffet that one should only invest in companies that they understand and believe will have a sustainable competitive edge in the market over other companies.

2. Do not try to predict the markets-

Never, try to time the markets because it is impossible to tell whether the market will go up or down in a certain period. Therefore, it is always advised to invest in the long run and not aim for short-term gains. People who do not understand the stock market often say that the stock market is equivalent to gambling. But that is not how the stock market works, it works on a cause-and-effect relationship. For every bull run or market crash there is a significant reason.

Stock markets are highly volatile and are affected by investor sentiments. Thus, one cannot predict the market.

3. Be patient-

Stock markets are highly volatile. And at times you might end up losing money. But never sell your investments out of panic. If you have done your research correctly then have faith in yourself. If you have invested in good companies with thorough background checks, then the period of your investments will give you good returns. And the stock market is not a one-day game. To see desirable results you need to have patience.

4. Be disciplined-

It is necessary to have discipline in the stock market to be profitable. Sometimes markets are volatile and perform against our expectations due to which we get carried away with our emotions and end up making rash decisions that we might regret later. So it is significant to have some investing rules and strategies that one should strictly follow. Invest in the market, check your investments regularly, make the timely necessary changes, have realistic expectations and be disciplined.

5. Power of compounding –

The compounding effect is the gathering of big rewards from a series of small and intelligent choices. Small, seemingly insignificant steps completed with discipline over a longer period can show exceptional results. An interesting fact is that Warren Buffet’s net worth graph closely resembles the graph of a compounding series. To experience the power of the compounding effect yourself is to start investing early. Today with so much technological advancement anyone can start their investing journey with as little as 500 rupees per month.

6. Buy when others are fearful –

When the stock market goes down for any reason most investors become fearful and start selling off their investments because of which the market becomes bearish and keeps on falling.

But someone who understands the stock market knows that it is the best time to buy because due to the overall market crash, the price of the shares of good companies also falls. Thus, they become undervalued. This offers an excellent opportunity for investors to enter the investment.

7. Sell when others are greedy –

Taking the other case scenario when the markets go up people become greedy and start investing more money into the markets till the saturation point. Again the smart investor will exit the market before the saturation point. Whereas most people keep on buying, and when the market corrects itself most people will lose money.

8. The rule of opposites-

This rule was given by the author of the famous book,” The Intelligent Investor” by Benjamin Graham. The more enthusiastic investors and spectators become in the long run (of investing), the more certain they are to be proved wrong in the short run because the stock market is unpredictable.

9. Continuous learning –

It takes years of practice and hard work to understand how the stock market works. Learning is a never-ending process and the person who thinks ‘they know it all’ is the biggest fool.

The quality that differentiates a successful person from a not-so-successful person is their attitude. The attitude of how they perceive things. The ocean of knowledge is very vast and one can never get enough of it.

10. Risk to reward-

In order to be a successful investor you should always pre-define your risks and rewards before entering into the markets. Because the greater the risk, the greater the reward. This is called the risk-return trade-off. The sole purpose of any investment is to minimize the risk and maximize the return. And it is advisable to never borrow money from others to invest in the stock market.

Read Also: 5 points to be considered before buying or selling any stocks

Conclusion

So, the key takeaway that you can take from the above article is that invest in your surroundings. Never try to predict the markets because the stock market is a very volatile market.

If you try to time the market you will end up making huge losses. Control your emotions, have patience, and be disciplined to see extraordinary results in the long run. And if you stick with something for long enough you will eventually figure it out. Stock market is a zero-sum game i.e. one person’s gain is another person’s loss. So, always buy when others are fearful and sell when others are greedy.

Read Also: Top 10 Books for Beginners in Trading & Investing

FAQs (Frequently Asked Questions)

How to start investing in the stock market?

In order to start investing in the stock market you need to open a demat account. There are various brokers present online where you can open a demat account for free and at the ease of your own comfort.

How to start investing in mutual funds?

There are various mutual funds present in the market where you can invest. You have to open a demat account before start investing in any kind of securities. There are various types of mutual funds present in the market. It depends on the preference of the investor in what kind of securities they want to invest in.

How to learn to invest in the stock market?

The first and foremost thing that is essential to learn when investing in the stock market is passion. One can only learn about investing in the stock market if they are passionate about the financial markets. Because understanding and learning about the stock market takes time.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.