| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-11-23 | |

| Internal linking | Nisha | Feb-18-25 |

- Blog

- what is an ipo mutual fund should you invest

What Is An IPO Mutual Fund? Should You Invest?

Recently, there have been a lot of new IPOs in Indian markets that have given stellar listing gains to investors. However, the better the potential IPO, the lesser the chances of getting an allotment for Retail Investors. Don’t worry; we will be discussing how you can invest in an Initial Public Offering (IPOs) via the mutual fund route.

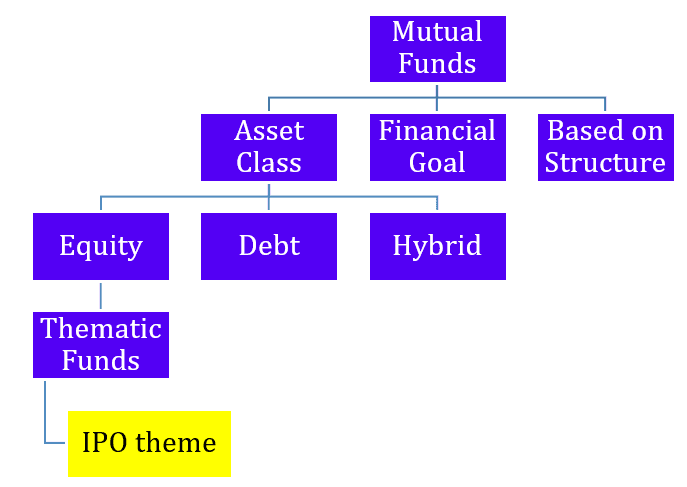

Mutual funds are pooled investments that aim to provide capital growth to investors in the long term. They are classified according to asset class, financial goals, and structure. In this blog, we will discuss the thematic funds—IPO theme.

Thematic funds are similar to sectoral funds, which fall under equity mutual funds category and are professionally managed by a fund manager. Their strategy involves investing in a particular theme, e.g., IPO theme, Digital and tech theme, etc.

There is one such mutual fund in the industry that will enable you to invest in quality IPOs without worrying about allotment status. We are referring to “Edelweiss Recently Listed IPO Mutual Fund”. It is a thematic fund that will assist you in investing in quality IPOs that have either recently been listed or are going to be listed on the exchanges.

Edelweiss converted its “Maiden-Opportunities Fund”, a close-ended scheme launched in February 2018, to the “Recently listed IPO Fund, an open-ended scheme” open to new investments since June 2021.

As per Edelweiss, the following is the strategy of the fund:

1. The fund will invest in the recent 100 IPOs to capture listing and post-listing gains.

2. The fund will invest in new-age businesses that are getting listed in the Indian market.

3. The fund will invest in companies across sectors with a bias towards small and mid-caps that promise growth.

4. The fund will not invest in weak businesses that can be highly impacted by market shocks.

Read Also: Why Invest in an IPO and its Benefits?

Characteristics of the Fund:

As of December 2023:

1. More than 72,000 people have invested in this mutual fund.

2. Its expense ratio is 0.92% and has an exit load of 2% if redeemed within six months.

3. Since inception, the fund has given an app. annualized return of 15%.

4. Only such thematic mutual fund available in the industry.

5. The fund’s asset under management (AUM) is INR 943 crs.

Positives if you invest in such thematic mutual funds:

- Get access to a large number of IPOs with minimal investment amounts without the headache of research and analysis.

- You don’t have to worry about the non-allotment of IPOs, as such funds place bids via the QIB route (Qualified Institutional Buyers).

- High growth potential as the fund will invest in new-age businesses with a bias towards small and mid-caps.

Negatives if you invest in such thematic mutual funds:

- IPO-themed funds are relatively new in the industry, with a minimal track record. Further, there is only one IPO-themed fund in the industry as of December 2023, so comparing its characteristics and returns can be challenging.

- Thematic funds have a narrowly defined investment focus, which provides less freedom to the fund manager to invest in profitable companies.

- The fund’s AUM may get smaller if the quality of new IPOs declines.

- Thematic funds are not suitable for short-term horizons. These funds may have negative or poor returns during the bear market or in the short term.

- Thematic funds substantially carry more risks than other categories of mutual funds, as news and events related to a particular sector can impact the entire sector.

Conclusion

We have discussed one of the thematic funds, the IPO theme. Thematic funds are equity mutual funds that invest in a particular theme. As we discussed above, the IPO theme is relatively new, and the only fund available in the industry as of now is the “Edelweiss Recently Listed IPO Fund”. Assessing the long-term prospects of such funds can be challenging. Further, thematic funds generally carry a higher risk than other categories of mutual funds because of their concentrated approach and smaller investment universe.

The optimal asset allocation approach is to choose mutual funds after consulting with a financial advisor and assessing your investment horizon and risk appetite. Investments in thematic mutual funds shouldn’t constitute a significant portion of your portfolio.

Read Also: What is an IPO Subscription & How Does it Work?

Frequently Asked Questions (FAQs)

What are some examples of thematic funds?

Digital and AI theme, IPO theme, Clean energy theme, etc.

What is the risk profile of thematic funds?

Thematic funds carry a very high level of risk.

How many IPO-themed mutual funds are available in the industry?

As of December 2023, only one fund invests in the IPO theme.

What are the Sectoral Funds?

Both are almost similar; thematic funds focus on themes such as IPO, Digital India, etc., while sectoral funds focus on a particular sector such as Healthcare, FMCG, Financials, etc.

What is QIB?

QIB stands for Qualified Institutional Buyers. These are institutional buyers with expertise in capital markets. Example: Mutual Funds, Alternative Investment Funds, Endowment Funds, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.