| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-24-23 | |

| FAQ and internal linking | Nisha | Feb-17-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- what is debt mutual funds invest in the best debt funds in india

What is Debt Mutual Funds: Invest in the Best Debt Funds in India

What are Debt Mutual Funds?

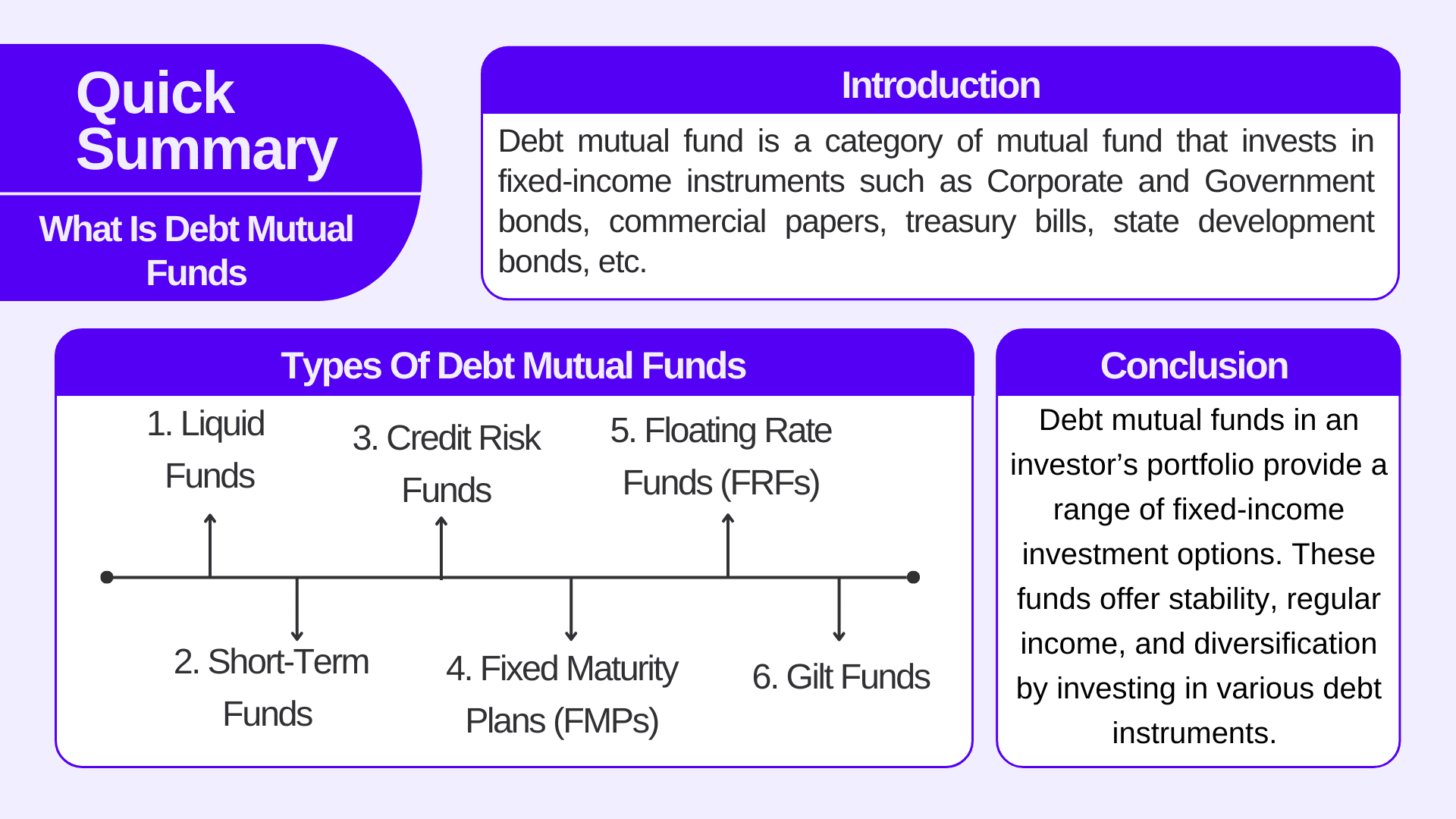

Debt mutual fund is a category of mutual fund that invests in fixed-income instruments such as Corporate and Government bonds, commercial papers, treasury bills, state development bonds, etc. (T-bills are short-term debt instruments or money market instruments that the government of India issues. These are generally given for 91 days, 182 days, or 364 days. They are provided to fulfill the short-term financial needs of the government).

The primary objective of debt mutual funds is to generate income for investors through interest payments while preserving the capital invested. Debt mutual funds allocate their holdings across various debt instruments to diversify the risk. This helps the fund manager reduce the impact of poor performance by any single security.

Debt funds invest in listed or unlisted securities, including corporate and government bonds. The NAV of the fund is calculated as the difference between the buy price and the sell price. Debt funds also receive regular interest from the underlying debt, which is added daily.

A debt fund’s NAV also depends on the interest rate. Debt mutual funds are open-ended funds, which means investors can buy or sell fund units on any business day at the fund’s net asset value (NAV). When considering debt mutual funds, it’s essential to assess your investment goals, risk tolerance, and time horizon and select funds that align with your financial objectives.

Who should invest in Debt Funds?

Debt Funds are suggested for individuals who prefer capital preservation to higher returns because debt funds provide investors with consistent returns and are less volatile. Investors who want a regular income but are risk-averse i.e., refrain from taking risks with their investments.

Read Also: Debt Mutual Funds: Meaning, Types and Features

How to invest in Debt funds

You can invest in direct debt funds through Asset Management Companies (AMCs), and in the case of regular debt funds, you need to contact mutual funds distributors (MFDs).

Types of Debt Mutual Funds

These categories of debt funds cater to different investor preferences and financial goals.

1. Liquid Funds

Liquid funds invest in very short-term debt instruments like T-bills, Certificates of deposits, and commercial paper and have a maturity of 91 days to generate optimum returns. Liquid fund invests in highly liquid money market instruments and debt securities. The best liquid funds to invest in India are ABSL Liquid Fund, Mahindra Manulife Liquid, PGIM India Liquid, SBI Liquid Fund, and Nippon Liquid Fund.

2. Short-term Funds

These funds invest in money and debt market instruments and government securities. The investment duration of these funds is longer than that of Liquid Funds. The best Short-term funds to invest in India are ICICI Prudential ST, UTI SD, HDFC ST Debt, Sundaram SD, and ABSL SD.

3. Credit Risk Funds

These funds invest in lower-rated corporate bonds and debt instruments to earn higher returns. The best Credit Rating Funds in India to invest in are DSP Credit Risk, Baroda BNP Paribas Credit Risk, Nippon India Credit Risk, and ABSL Credit Risk.

4. Fixed Maturity Plans (FMPs)

FMPs are close-ended mutual fund schemes, and the maturity dates in FMPs are decided beforehand. They invest in debt instruments with a specific date of maturity. FMPs are issued for a period ranging from 30 days to 60 months, and units of FMPs are listed on the stock exchange.

5. Floating Rate Funds (FRFs)

FRFs invest in instruments that offer a floating interest rate on your investments in bonds, government securities, and debentures. The best-floating Rate Funds to invest In India are ABSL Floating Rate, Franklin Ind Floating Rate, and HDFC Floating Rate.

6. Gilt Funds

Gilt in Gilt funds stands for government securities. This fund invests your capital in government securities issued by central and state governments. This fund offers you low credit risk and moderate returns. The best Gilt Funds to invest in India are ICICI Pru Gilt Fund, SBI Magnum Gilt Fund, DSP Govt. Securities Gilt Fund, and Kotak Gilt Investment.

7. Dynamic Bond Funds

These funds invest in debt securities with different maturity periods and actively manage the fund’s interest rate risk. Returns vary based on market conditions. Above mentioned are some of the types of debt mutual funds. There are various other types, which we shall discuss later. The best Dynamic Bond funds to invest in India are ABSL Dynamic Bond Fund, ICICI All Seasons Bond Dir, HDFC Dynamic Debt, and 360 ONE Dynamic Bond.

8. Monthly Income Plans (MIPs)

MIPs are hybrid schemes that invest in a mixture of debt and equity. However, the allocation in equity is about 15-20% only. These funds offer regular income in the form of dividend payouts. However, you don’t need to receive dividend payments because it is at the discretion of the AMCs and depends on the surplus left from realized gains.

Taxation of Debt in India

Tax in debt is divided into two parts.

Short-term gain and long-term gain where the short-term duration is less than three years as per your income tax slab, and for long-term, it is more than three years at the rate of 20% with indexation benefit. (Indexation- means adjusting your purchase cost based on inflation). Now let us go through the advantages and disadvantages of investing in debt funds before jumping to any conclusion as to why to choose debt funds.

Advantages of Investing in Debt Funds

1. Stability & Safety

Debt Funds invest in fixed-income securities, which are stable and safe compared to other investment options like stocks.

2. Regular Income

Debt securities like MIPs and FMPs help the investor receive regular income through interest payments.

3. Diversification

With the help of debt funds, investors’ exposure to risk is reduced because debt funds generally have less exposure to equities, reducing the portfolio’s overall risk.

4. Tax Efficiency

If you want an escape from taxes, debt funds can be a solution because these funds carry more tax efficiency than any other traditional investment option like FDs and post office schemes. FMPs can offer investors tax advantages because of indexation benefits.

5. Liquidity

Debt funds are generally more liquid than FDs. Investors can buy or sell these funds on any business day, providing liquidity when needed, and these funds do not have any lock-in period. However, they do carry minimal exit load in some funds.

Read Also: Why Debt Funds Are Better Than Fixed Deposits of Banks?

Conclusion

Debt mutual funds play a vital role in an investor’s portfolio by providing a range of fixed-income investment options. These funds offer stability, regular income, and diversification by investing in various debt instruments. The choice of debt funds depends upon factors like risk appetite, investment horizon, and financial goals. But it would help if you remember that debt funds are not entirely risk-free. Investors should consider consulting a financial advisor for personalized advice.

Frequently Answered Questions (FAQs)

What are debt mutual Funds?

Debt mutual fund is a category of mutual fund that invests in fixed-income instruments such as Corporate and Government bonds.

What are the different types of debt funds?

Different types of debt mutual funds include short-term funds, Fixed maturity period funds, gilt funds, credit risk funds, etc.

What is the taxation rate on long-term capital gains in debt mutual funds?

The tax rate on debt mutual funds for the long-term is more than 3 years at 20% with an indexation benefit.

What are T-bills?

T-bills are treasury bills that the Government of India issues to meet short-term financial needs.

What is the complete form of MIPs?

MIP stands for monthly income plan.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle