| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-06-24 | |

| internal linking and keyword | Default Author | Feb-17-25 | |

| internal linking and keyword | Nisha | Feb-17-25 | |

| Infographic Update | Ranjeet Kumar | Apr-04-25 |

Read Next

- What is Commodity Valuation?

- Exchange of Futures for Physical (EFP)

- Commodity Arbitrage – Types & Strategies in India

- Top Major Commodity Exchanges in India

- The Pros and Cons of Commodity Trading

- What is the Commodity Index?

- Types of Commodity Market in India

- Tax on Commodity Trading in India

- Understanding Commodity Market Analysis

- Risks in Commodity Trading and How to Manage Them

- 5 Tips for Successful Commodity Trading

- Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders

- Commodity Trading Regulations in India: SEBI Guidelines & Impact

- What is the Timing for Commodity Market Trading?

- Stock Market vs Commodity Market

- How to Trade in the Commodity Market?

- What is Commodity Market in India?

- Blog

- what is ncdex

What Is the National Commodity and Derivatives Exchange (NCDEX)?

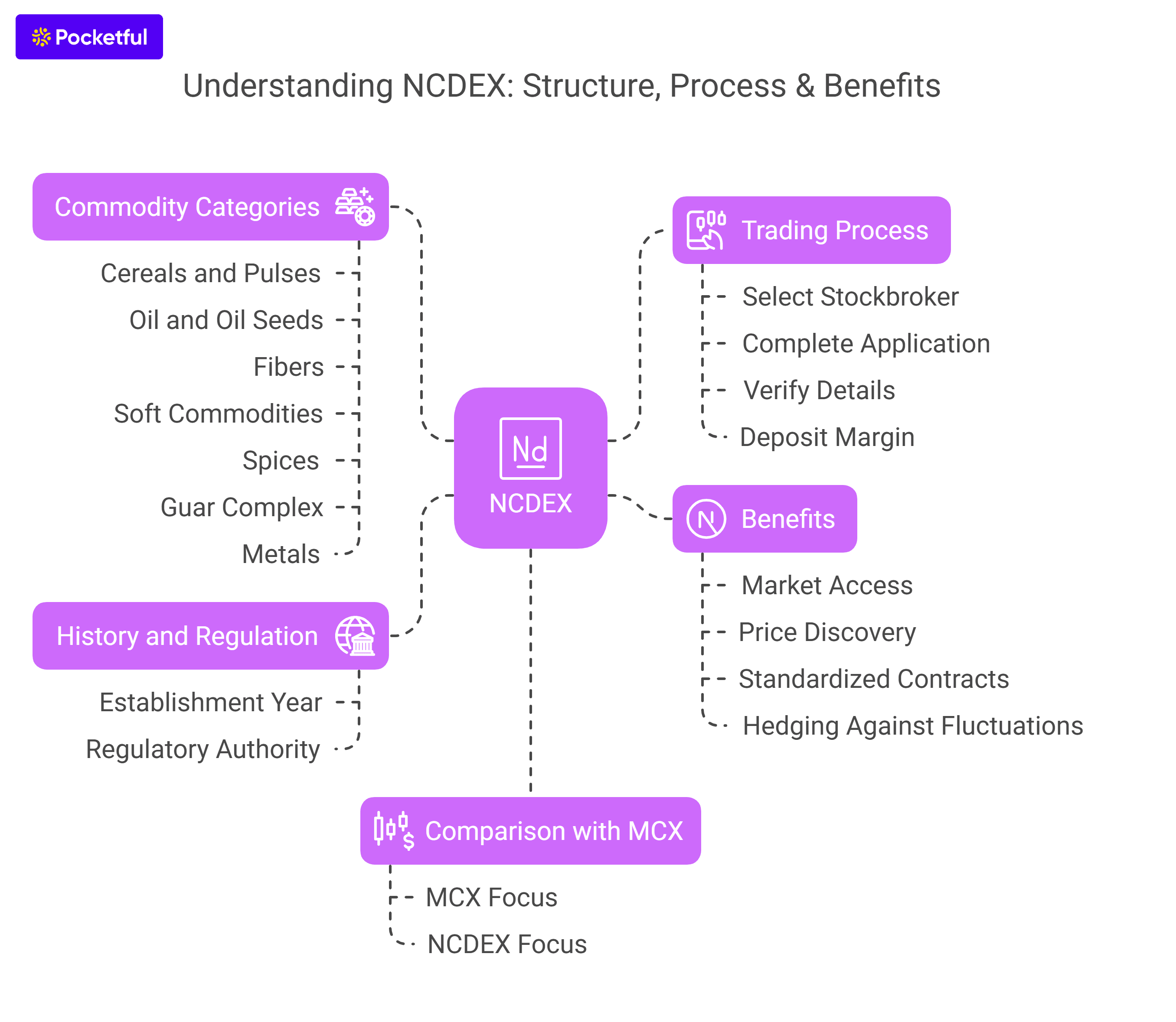

The derivative segment for equities and indices in India gets traded on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), but what about derivative contracts on agricultural and non-agricultural commodities? NCDEX, or National Commodity and Derivatives Exchange Limited, provides an online commodity exchange exclusively for commodities and derivatives trading.

In today’s blog, we will explore how to create an NCDEX account, its trading process, and its benefits.

What is NCDEX?

National Commodity and Derivatives Exchange Limited is an online commodity exchange dealing primarily in agricultural commodities in India. It has a diverse range of products to fulfill the needs of different participants. NCDEX is under the regulatory authority of the Securities and Exchange Board of India (SEBI). It was established in 2003 and has its headquarters in Mumbai.

NCDEX provides market access to those who wish to protect their commodities against price volatility. It also allows traders to speculate on the price movement of the commodities to generate profits.

The exchange offers derivative contracts for agricultural and non-agricultural commodities across seven categories. The seven categories are listed below:

- Cereals and Pulses: Chana, Barley, Bajra, Wheat, etc.

- Oil and Oil Seeds: Groundnut, Crude Sunflower oil, Castor seed, Soybean, etc

- Fibers: Kapas, 29 MM Cotton

- Soft: Gur, Robusta Cherry AB coffee, Isabgol seed

- Spices: Turmeric, Coriander, Jeera, Jeera Mini

- Guar Complex: Guar seed 10 MT, Guar Gum refined splits

- Metals: Steel Long

How to Open and Trade in an NCDEX Demat Account?

To start trading on the NCDEX platform, we first need to create an NCDEX account by following the steps given below:

- Select a stockbroker by comparing its benefits and costs with other stockbrokers.

- Complete the application form to open an NCDEX account and give personal and bank details. Opening an account also requires documents such as a PAN card, Aadhaar Card, etc.

- The stockbroker verifies all your details and approves them.

- When all the details have been verified, the stockbroker will open your NCDEX account.

- You can deposit a margin amount in the account and start placing orders on the exchange.

- Once the order is executed, you can monitor the P&L and must ensure that sufficient funds are maintained.

Examples of NCDEX

Suppose you are a farmer who grows wheat and expects to harvest the crop three months from now. Prices three months from now can vary from the prices offered today. These unexpected price fluctuations create a risk as the market price of wheat can decline, resulting in reduced profits or even losses for the farmer. In such a situation, the farmer can create a short position in the derivative contract of wheat. Now, there can be two scenarios:

- If wheat prices decrease, then the farmer incurs losses on selling the crop at lower prices, but the short position in the derivative contract offsets these losses.

- If wheat prices increase, then the farmer profits from selling the crop at higher prices, but the short position in the derivative contract offsets these profits.

The derivative contract hedges your long position in wheat and thus fixes your profit.

Read Also : What is the Timing for Commodity Market Trading?

What are the Benefits of NCDEX?

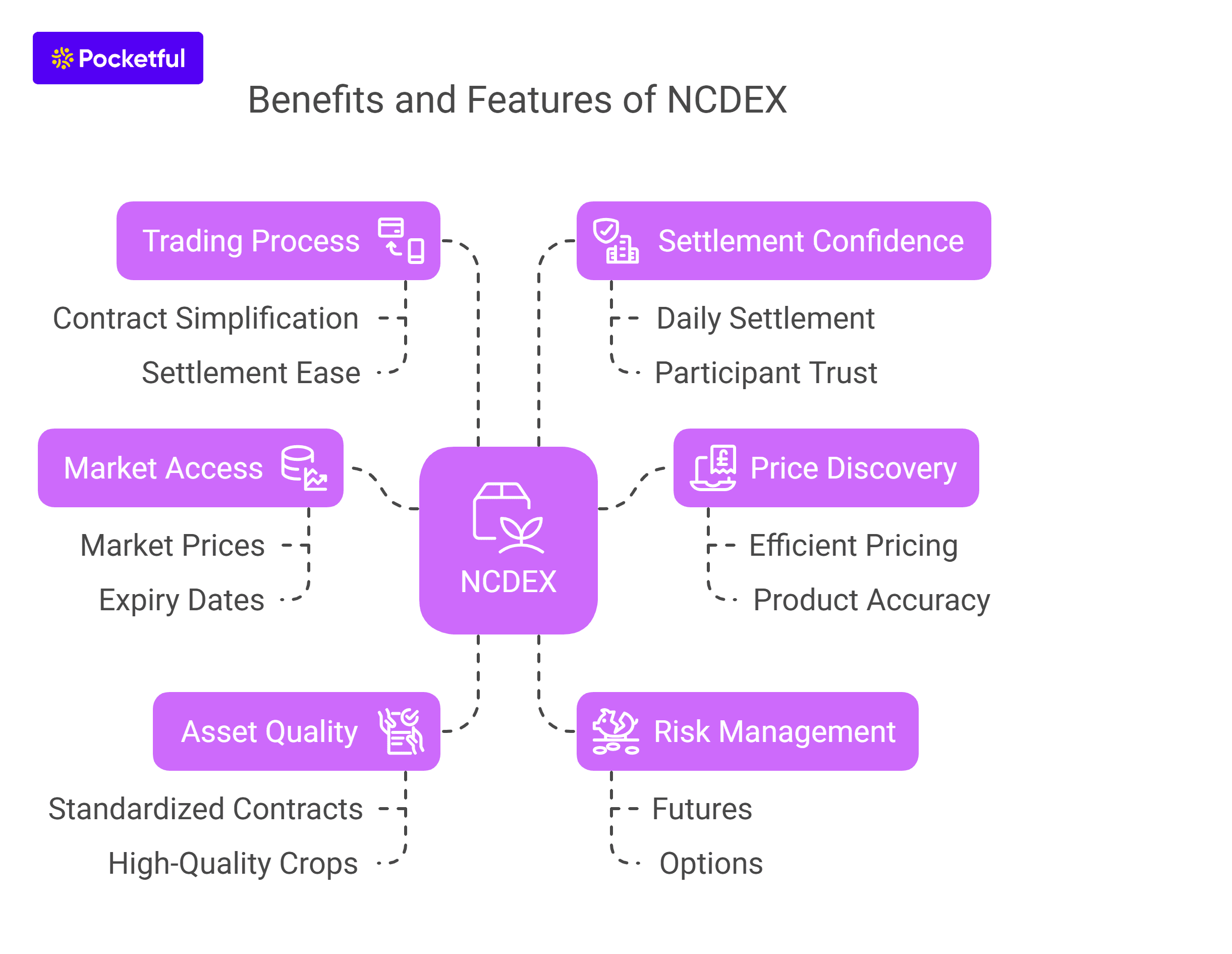

To take advantage of the NCDEX platform, we must understand its features listed below:

- Participants can access market prices, expiry dates, and other important information using the NCDEX platform.

- Owners of the assets can use the NCDEX as an efficient price discovery platform to price their products more accurately.

- NCDEX has standardized underlying asset quality through contracts, which has resulted in an enhanced focus on producing high-quality crops.

- Agricultural commodities are prone to seasonal fluctuations, resulting in significant losses. We can hedge against these price fluctuations using commodity derivatives like futures and options available on the NCDEX.

- NCDEX offers standardized contracts, which simplifies the process of trading and settlement of contracts.

- NCDEX follows the mark-to-market settlement cycle, in which the profits and losses are settled at the end of each trading day. This practice helps build confidence among market participants that the contract will be honored.

Check Out – Search and Filter Commodities

What is the Difference Between MCX and NCDEX?

Multi Commodity Exchange (MCX) and National Commodity and Derivatives Exchange (NCDEX) are prominent commodity exchanges in India. Both platforms allow trading in commodities but are different from each other as they deal in different commodities. MCX offers contracts in silver, gold, and other metals, whereas NCDEX offers products primarily related to agricultural goods.

Read Also : MCX Exchange Case Study

Conclusion

National Commodity and Derivatives Exchange Limited (NCDEX) is one of the largest commodity Trading Plateform exchanges in India. It provides market participants an opportunity to hedge against market fluctuation and trade to earn profits.

Trading in derivatives can be complex, often resulting in huge losses. Investors must have thorough knowledge regarding derivatives and should consult their financial advisor before making any investment decision.

Frequently Asked Questions (FAQs)

What is NCDEX?

NCDEX, or National Commodity and Derivatives Exchange Limited, is a commodity exchange dealing in agricultural commodities in India.

Who owns NCDEX?

Major shareholders of NCDEX are NSE (15%), LIC (11.1%), NABARD (11.1%), etc.

What is the difference between NCDEX and MCX?

NCDEX primarily focuses on trading agricultural commodities, while MCX deals with a broader range of commodities, including metals, energy, etc.

Where are the headquarters of NCDEX?

The NCDEX headquarters is located in Mumbai.

How can I trade on NCDEX?

To trade on the NCDEX, one must have an NCDEX account with a registered broker. After registration, one needs to deposit a margin and start trading.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle