| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-06-23 | |

| FAQ and internal linking | Nisha | Feb-17-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- what is nifty 50 how to invest in it

What Is Nifty 50? How To Invest In It?

You must have heard these statements: “Nifty hits a new high, Nifty crashes 500 points”…

You must be wondering: What exactly is Nifty 50? What is it, what happens if it rises or falls, and how do I invest in it? We will unwind all these questions in this blog.

The Nifty 50 is an equity market index comprised of the 50 largest publicly traded companies in India. It was launched in 1996 and is currently managed by NSE Indices Ltd. (formerly NSE Strategic Investment Corporation Limited).

The 50 stocks included in the Nifty 50 are selected based on their free-float market capitalisation*. These 50 stocks can also be considered “blue-chip” stocks, as they are India’s largest and most liquid equity securities.

*Free float market cap: (outstanding shares – locked-in shares) X current market price

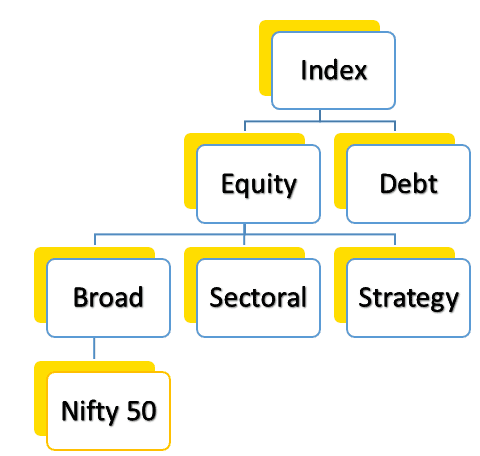

Nifty 50 is used to gauge the overall market sentiment, as 50 stocks in the Nifty 50 index are blue-chip companies from different sectors. There are numerous categories in the index universe, ranging from equity to debt, broader to concentrated. We will cover this in detail in a separate blog.

Apart from the Nifty 50, there is another broader market index in India, the Sensex. It is also a free-float market-weighted index but consists of 30 stocks compared to 50 in the Nifty 50 index.

Fact: All NSE indices are managed by a team of professionals. The governance structure of NSE Indices Limited consists of three tiers: the Board of Directors, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

Index Variants:

There are multiple variants of the Nifty 50 Index:

- Nifty 50 USD: A US dollar-denominated Nifty 50 index.

- Nifty 50 Total Returns Index: In this, the dividends received from the constituent stocks are also factored into the index values, as a price index does not consider the returns arising from dividend receipts. Therefore, to get a true picture, the Nifty 50 Total Returns Index, which includes the dividends received, was established.

- Nifty 50 Dividend Points Index: The Nifty 50 Dividend Points Index is designed to track the total dividend from the constituents of the Nifty 50 index.

Read Also : NIFTY Next 50

Criteria For Stocks To Be Included In Nifty 50

There are certain criteria that need to be fulfilled for a stock to be included in the Nifty 50 Index:

- Constituents of the Nifty 100 index that are available for trading in the NSE’s Futures & Options segment are eligible for inclusion in the Nifty 50 index.

- The company’s trading frequency should have been 100% in the last six months.

- The security should have traded at an average impact cost* of 0.50% or less during the last six months for 90% of the observations for a portfolio of INR 10 crores.

- The company should have a listing history of six months.

- The company should have a minimum listing history of 1 month as of the cut-off date.

*Market impact cost (cost of executing a transaction) is the best measure of the liquidity of a stock. It accurately reflects the costs incurred when trading an index.

Re-balancing

The index undergoes testing every six months to see if rebalancing is necessary. The cut-off dates for the assessment of indices are January 31 and July 31 of each year. This means that the average data for the six months leading up to the cut-off date is taken into consideration. The market is notified four weeks in advance of the date of change.

Let’s understand this with an example: Assume Adani Enterprises Ltd. fell 50% and is no longer in the list of the 50 largest businesses by free float market cap; therefore, at the time of rebalancing Nifty 50, it will be replaced by the next stock in the Nifty Next 50 index list.

The inclusion and exclusion of any particular stock can create temporary volatility in that stock because of adjustments made by numerous index funds and ETFs.

Stocks In The Nifty 50:

As explained above and suggested by the name itself, it consists of 50 stocks. Some major names are Reliance, HDFC, SBI, Infosys, ITC, etc.

Top constituents by weightage as of October 2023:

| Company’s Name | Weight (%) |

|---|---|

| HDFC Bank Ltd | 13.24 |

| Reliance Industries Ltd. | 9.25 |

| ICICI Bank Ltd | 7.66 |

| Infosys Ltd. | 5.84 |

| ITC Ltd. | 4.53 |

| Larsen and Toubro Ltd | 4.23 |

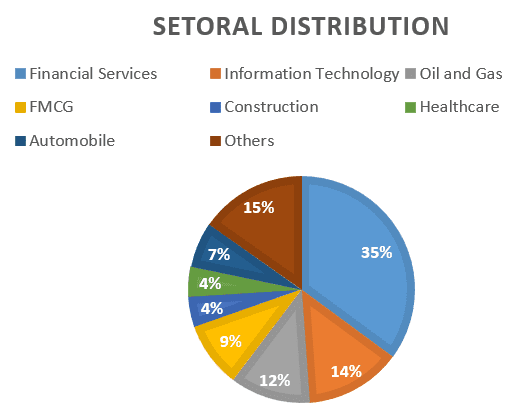

Sectoral Distribution

Nifty 50 currently has exposure to 13 sectors, with the financial sector making up the majority. Have a look at the pie chart below (as of October 2023):

Purpose of Nifty 50

Now you must be wondering: What is the use of an index? The Nifty 50 plays an important role in shaping market sentiments and forms the basis for multiple investment strategies.

An index can be used for several purposes:

- To gauge broader market sentiments.

- Act as a benchmark for actively managed portfolios.

- Acts as an economic indicator.

- Forms the basis for various investment products, such as index funds, ETFs, index-based derivatives, etc.

How To Invest In Nifty 50:

There are multiple ways to do it:

- Index Fund

- ETF

- Direct Investing: Individually own all 50 stocks as per the actual weightage (not recommended)

Pro tip: Always go with the index fund with the lowest expense ratio and tracking error. These factors differentiate an index fund, as all the Nifty 50 index funds invest only in those 50 stocks.

Check out our blog on Index Funds vs ETFs!

Benefits of Investing in Nifty 50:

- Diversification: The major benefit of investing in broader market indices such as Nifty 50 is diversification, which means you are no longer exposed to any particular stocks or sector.

- No Biasness: Stock selection is purely based on free-float market capitalization, eliminating human bias.

- Less Expensive: Index funds and ETFs are less expensive than active mutual funds.

Demerits of Investing in Nifty 50:

- Risk of return: Over a long time horizon, broad market indices generally correlate with a country’s economy. If a country is not doing well economically, it may give negative to nil returns on investment. Consider the example of Japan’s premier index, Nikkei 225. Between 1991 and 2023, it generated an approximate return of just 40%.

- If any particular stock rises so much, it may cause significant movements in the index, and the index no longer represents the sentiments of the market; it is basically one stock moving the index.

- While the Nifty 50 is a diverse index, it may not fully represent the entire Indian market, for example, small-cap and mid-cap stocks. As of March 2023, there are 2,137 listed companies on the National Stock Exchange.

Nifty 50 Returns

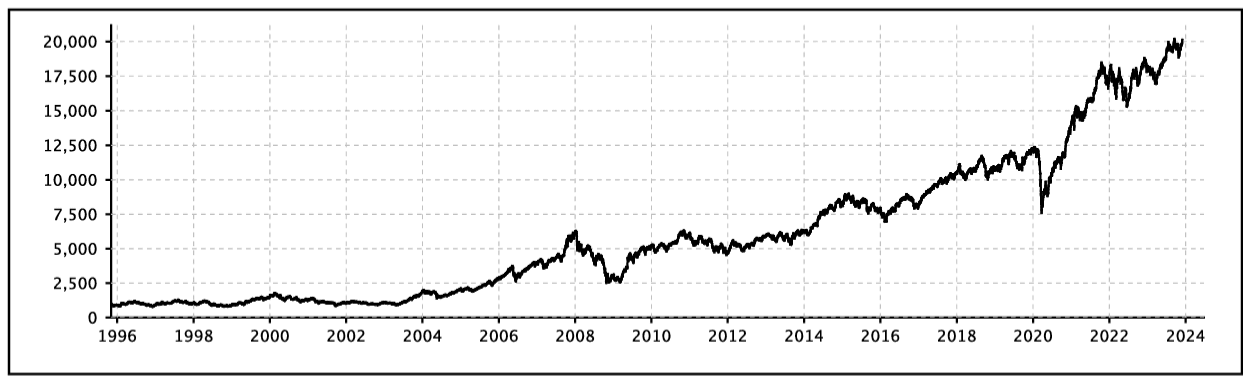

Over the last few decades, Nifty 50 has performed incredibly well. Have a look at the snippet below:

The above chart is from 2000 to 2023 (November). It has given returns of app. 11 times during this period, which means 1000 rupees invested in 2000 have now become 11,000 in 2023.

From November 1995 (inception) to November 2023, Nifty 50 has generated an annual return of 11.28% (excluding dividends).

Conclusion:

The Nifty 50 index is a well-diversified index comprising 50 companies reflecting the overall market, with the finance sector being the majority. The free-float market capitalization method is used to calculate it. Its diverse composition, historical significance, and role as a benchmark make it a crucial element for investors. The Nifty 50 can be used to benchmark fund portfolios, launch index funds, and ETFs, among other things. There are several uses of an Index in the financial world. Buying a low-cost index fund is the ideal way to invest in the Nifty 50.

Frequently Asked Questions (FAQs)

How many stocks are there in the Sensex index?

30 stocks, while Nifty 50 consists of 50 stocks.

What is the ideal method to invest in Nifty 50?

Low-cost index fund.

Does buying Nifty 50 mean taking a small piece of the entire market?

Not really. Although the Nifty 50 is a diverse index, it may not fully represent the entire Indian market, for example, small-cap and mid-cap stocks.

Is the Nifty 50 a broad market or strategy index?

Broad market index

In how many months is the rebalancing of the Nifty 50 tested?

Nifty 50 is tested for rebalancing every six months. The cut-off dates are January 31 and July 31 of each year.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle