| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-25-23 | |

| FAQ and internal linking | Nisha | Feb-15-25 | |

| FAQ and internal linking | Nisha | Feb-15-25 |

Read Next

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

- List of Best Commodity ETFs in India

- Bullish Options Trading Strategies Explained for Beginners

- Best Brokers Offering Free Trading APIs in India

- Top Discount Brokers in India

- Best Charting Software for Trading in India

- Benefits of Intraday Trading

- What are Exchange Traded Derivatives?

- What is Margin Shortfall?

- What is Central Pivot Range (CPR) In Trading?

- Benefits of Algo Trading in India

- Blog

- what is the gap up and gap down strategy

What Is The Gap Up And Gap Down Strategy?

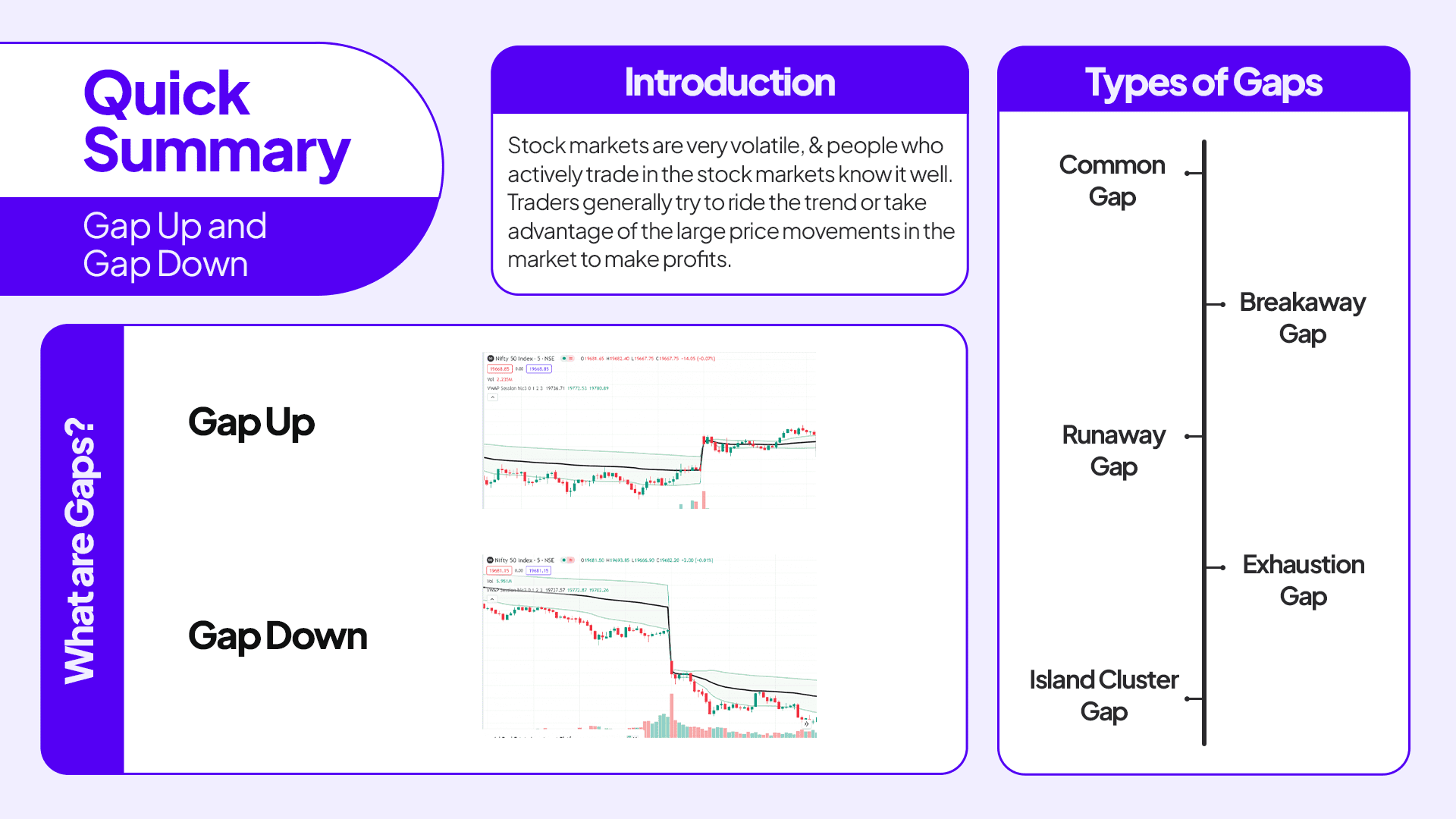

Stock markets are very volatile, and people who actively trade in the stock markets know it well. Traders generally try to ride the trend or take advantage of the large price movements in the market to make profits. Every trader in the stock market uses their own set of strategies to trade the market. Some use chart patterns, price action, indicators etc. Among all these, one of the most famous strategies that traders use is the Gap up and Gap down strategy. Here, they try to book profits based on the gap up and gap downs in the market. Mostly gap up and gap down are seen, during the start of the trading sessions in the market.

The given article gives a broad framework of the Gap up and Gap down strategy. After reading this article you will be thorough with what is in the stock market, why they occur, the types of gaps and the perfect strategy to trade the market using the Gap ups and Gap downs.

What Are Gaps In The Stock Market?

Gaps are the area of discontinuity in the price chart of a security. Gaps are the impact on the price of a stock because of the overrun activities in the previous day, seen in the next trading session. Gaps can be of two types in the stock market. One is Gap up and the other is Gap down.

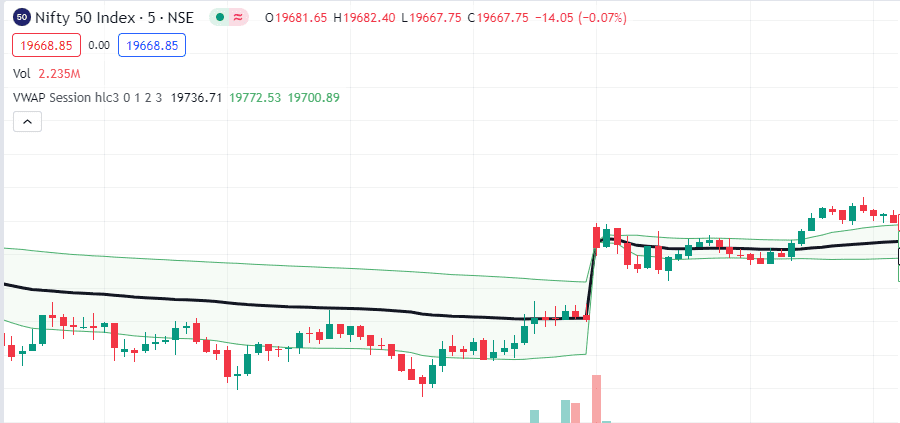

- Gap-up:

When the opening candle of the day has opened above the closing of the previous day then it is called a Gap up in the market. The candle could be a bulling or bearish candle. The colour of the candle signifies its type. A red candle is a bearish candle and a green candle is a bullish candle.

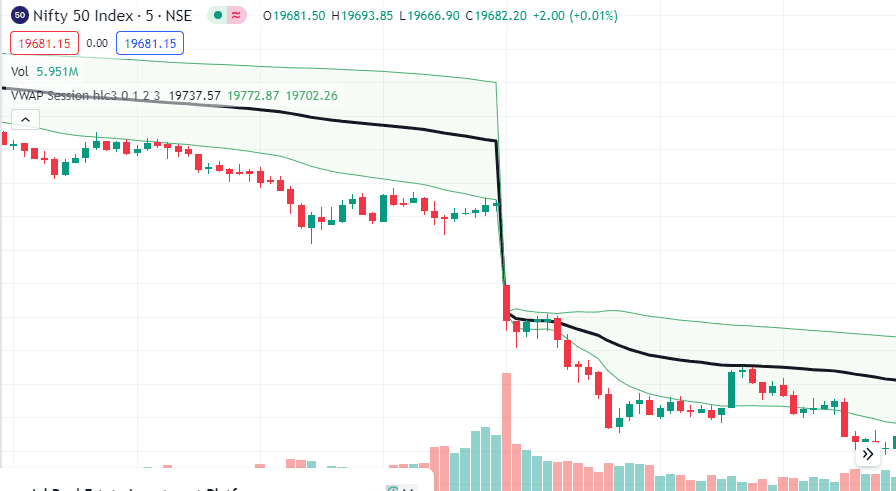

- Gap down:

When the opening candle of the day has an open, below the closing of the previous day’s last candle, then it is called a Gap down in the market. The same rule applies to the Gap up. The candle could be bearish or bullish. A red candle is a bearish candle and a green candle is a bullish candle.

Read Also: Downside Tasuki Gap Candlestick Pattern

Why do Gaps Occur In The Markets?

- Gaps generally occur because of the bidding in the pre-open markets. So, accordingly, we see Gap ups and Gap downs in the market. The actual trading in the stock market begins at 9:15 but, before that, there is a pre-open market session of 15 minutes wherein you can place your orders depending upon the pre-open prices in the market.

- Earlier what people used to do was in case if the market opened with a Gap down they would make buy positions there, with the possibility that this gap would be filled in the coming market hours as the market always corrects itself. And in case of a Gap people generally make sell positions with the possibility that this gap will be filled in the coming market hours, as the market always corrects itself and the trend will reverse.

- Another reason for Gaps in the markets could be, companies disclosing their quarterly earnings. For instance, if the results of a company are declared in off-market hours, in case of good results the probability is high, that in the next market session, the stock will surely give a Gap up opening and vice versa in case of poor quarterly results.

- Algo trading or automated program trading is also a new factor that affects or influences the Gaps in the market. For easy understanding let’s say, that the trading algorithm might indicate a large buy order because a prior high or the resistance level is broken. The volume of an algo trade might be such that it triggers a price gap in the market, breaking the recent resistance levels indicating other traders to the directional movement.

Types Of Gaps In The Market

There are 4 main types of Gaps in the stock market which are listed below:

Common Gap

A common gap shows the area on the chart where the price gets discounted. Mostly when a gap is formed within the market range then it is called a common Gap. when the fluctuation is going on in the market common gaps are formed within the range of the supply and the resistance levels in the market.

Breakaway Gap

When the markets open the first candle of the day forms at the resistance or the support levels of the market, then this gap is called the Breakaway Gap.

Runaway Gap

It is generally seen in a trending market either in a bullish trend or a bearish trend. Suppose that the market is going in an uptrend and the next day the the stock price shows a gap up following the previous day’s trend.

Traders check for volume at these levels. And if volumes are good they make a buy position here. The same thing applies in the case of the downward trend.

Exhaustion Gap

This type of Gap is also mostly seen in a trending market but here you got to see a gap the next day. If you see a Gap in the trending market, then you have to check the volume. If volumes are less, then you can use a strategy.

You saw that the market opened a Gap up, volume is low, the next candle is bearish then it is an exhaustion Gap.

Island Cluster Gap

When the Gap up and Gap down are adjacent to each other, a reversal pattern is observed here. This type of gap is called an Island Cluster Gap.

Read Also: Upside Tasuki Gap Pattern

A Strategy To Play The Gaps

Below are some very simple ways that you can take into account to develop a trading strategy based on Gaps.

A gap-up stock in an uptrend provides a good opportunity to buy and hold a long position. A gap-down stock experiencing a decline in price in an uptrend provides a good opportunity to buy. A gap-down stock in a downtrend provides a good opportunity to short-sell.

The most effective Gap stocks to trade in the share market are those that are volatile and thus have more price fluctuations. Therefore, you should consider the sector that you would like to trade in. For example, oil and gas, pharmaceutical and retail stocks are considered particularly volatile sectors to trade, especially in the face of adverse economic conditions or a national recession.

FAQs (Frequently Asked Questions)

How to predict Gap up and Gap down?

Gap up and Gap down generally depend on various technical and fundamental factors.

How to trade Gap up and Gap down?

In case of a gap down, traders generally set a buy position with the assumption that this gap will be filled by the market correction.

What is meant by gap-filling?

Gap filling is when the price closes as the previous day closes.

How to start trading in the stock market?

To start trading in the stock market, you need to have a Demat account. You open a Demat account using Pocketful.

What is the Gap pattern Trading Strategy?

It is a simple and disciplined approach for buying and shorting stocks in the stock market.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle