| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-08-24 |

Read Next

- SEBI Action on Jane Street: Impact on Indian Markets

- What is Personal Finance?

- Military Wealth Management: Strategies for Growing and Preserving Your Assets

- India’s Republic Day 2025: Honoring the Nation’s Defense Achievements

- 10 Essential Financial Planning Tips for Military Members

- How Do You Apply for PAN 2.0 Online and Get It on Your Email ID?

- 10 Best YouTube Channels for Stock Market in India

- LTP in Stock Market: Meaning, Full Form, Strategy and Calculation

- 15 Best Stock Market Movies & Web Series to Watch

- Why Do We Pay Taxes to the Government?

- What is Profit After Tax & How to Calculate It?

- Budget 2024: Explainer On Changes In SIP Taxation

- Budget 2024: F&O Trading Gets More Expensive?

- Budget 2024-25: How Will New Tax Slabs Benefit The Middle Class?

- Semiconductor Industry in India

- What is National Company Law Tribunal?

- What is Capital Gains Tax in India?

- KYC Regulations Update: Comprehensive Guide

- National Pension System (NPS): Should You Invest?

- Sources of Revenue and Expenditures of the Government of India

- Blog

- what to expect in the budget 2024

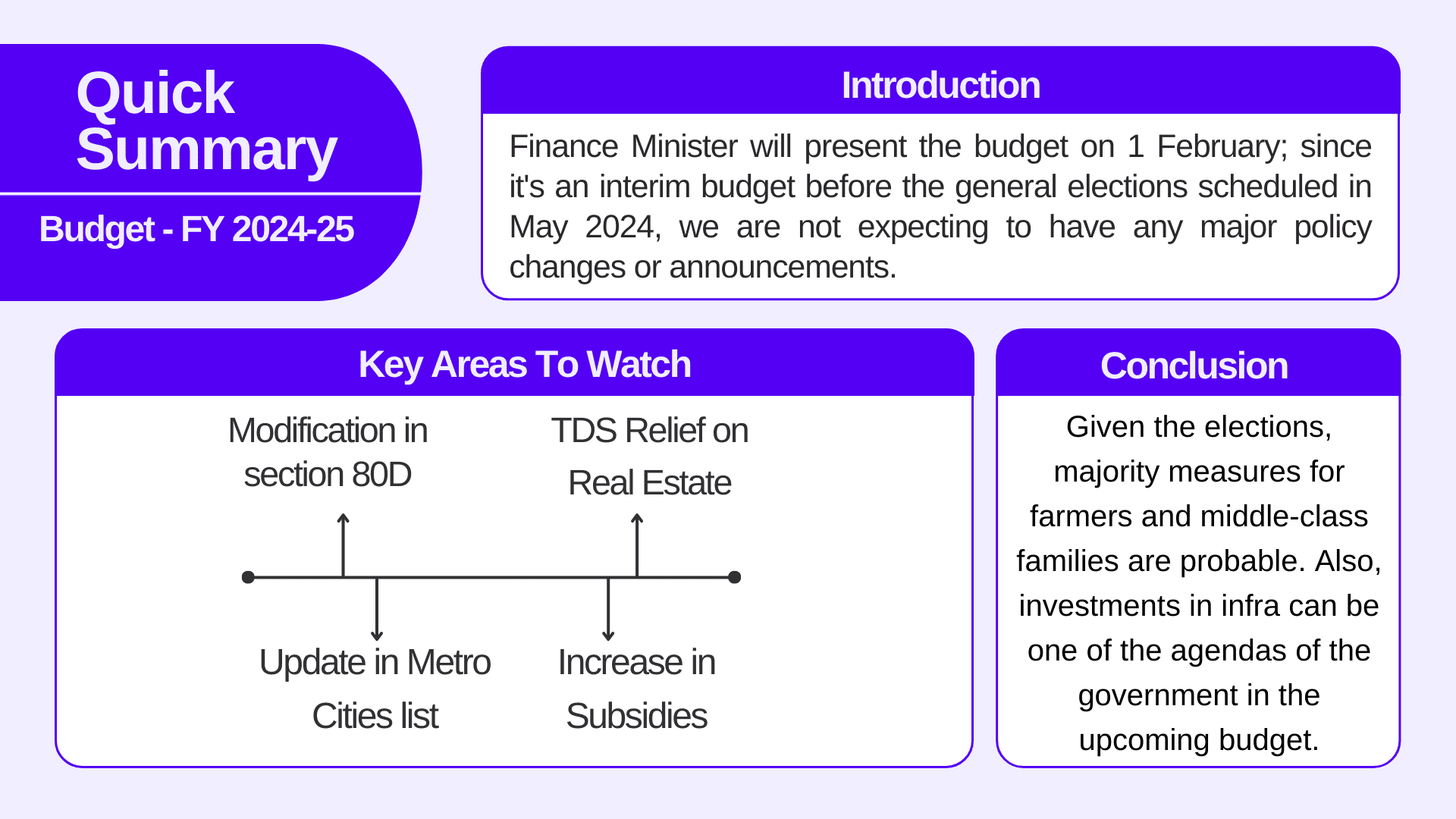

What To Expect In The Budget 2024?

Last year, on 1 February 2023, i.e., on the budget day, the govt. made significant announcements such as increased spending on infrastructure, several aids for agriculture and entrepreneurs, increase in tax rebate, etc., for the FY 2023-24.

Now, the budget for the FY 2024-25 is yet to be presented. Finance Minister Nirmala Sitharaman will present the interim budget 2024-25 on February 1, 2024.

In this blog, we will discuss what to expect in the upcoming budget and past year trends.

What is Interim Budget?

An interim budget is a temporary financial plan presented by the government when the general elections are forthcoming. Compared to the regular budget, the interim budget is less comprehensive and does not introduce many policy changes.

An interim budget generally includes a review of the previous year’s budget, i.e., the government’s income and expenditure for the previous financial year and an estimate for the upcoming financial year.

What to expect in the upcoming Budget?

Finance Minister Nirmala Sitharaman will present the budget on 1 February; since it’s an interim budget before the general elections scheduled in May 2024, we are not expecting to have any major policy changes or announcements. The major focus will likely be maintaining macroeconomic stability and continuing existing schemes.

However, there are some expectations about what can be included in the Budget 2024.

Below are some key areas to watch:

- Under section 80D, the deduction limit for medical insurance premiums can be increased from INR 25,000 to INR 50,000 in the case of individuals and from INR 50,000 to INR 75,000 in the case of senior citizens.

- Currently, TDS deducted on property acquisitions is 1% if the value of the property exceeds INR 50 Lakhs. The government is planning to ease TDS compliance for people who wish to invest in real estate.

- Bangalore is to be considered a metro city for the exemption of the house rent allowance for its residents, which means 50% of basic pay will be determined as HRA. As of now, Bangalore is not classified as a metro city for HRA deduction, means only 40% of basic pay is determined as HRA.

- The government’s subsidy* bill can see a slight increase in the upcoming financial year 2024-25 because of the expansion of the central government’s free food scheme.

*If you’re not familiar with the word, Subsidy is a kind of financial aid the government provides to individuals, businesses, or institutions. It can include reductions or exemptions from taxes, loans at lower interest rates, cash transfers or grants.

- We can also expect a new reverse charge-based mechanism to improve GST compliance. This will avoid monthly tax payment obligations by small business vendors since buyers who are large taxpayers with turnovers above INR 100 crore will directly pay the tax to the government.

Read Also: Unveiling the Budget 2024: Key Takeaways

A quick look at FY 2023-24 allocation of Budget.

Some of the major sectors accounted for 53% of total estimated expenditure in the previous financial year budget:

- Defence – the budget of the defence sector was about INR 593,000 crore and accounted for over 13% of the total expenditure of the central government. In 2023-24, its allocation is estimated to be marginally lower than 2% of GDP.

In the interim budget, we can expect a marginal rise of 1-2% for the defence sector.

- Railways – In the FY 2023-24, the government has allocated a budget of around INR 240,000 crore for capex in the railway sector.

We can expect a rise of 2% for capex in the railway sector in the forthcoming FY 2024-25 budget.

- Road Transport & Highways – A budget of INR 270,000 crore was allocated to the road & transport ministry in the FY 2022-23, which was 25% higher than the revised estimates for 2022-23.

This year, we can expect an estimated rise of 30% in the upcoming interim budget.

- Agriculture – India, an agricultural country, had an allocation of INR 125,000 crore in the FY 2023-24, which was a 5% increase over the revised estimates of 2022-23.

A rise of 5-7% for agriculture and farmer’s welfare can be expected in this financial year.

- Communication – the Indian government primarily focused on this sector with a budget of INR 1 lakh crore in the previous financial year of 2023-24.

This year we can expect a rise of 30-35% in budget allocation of this sector.

Subsidies for FY 2023-24

Expenditure on subsidies accounts for a major portion of the government’s total budget, with an amount of INR 400,000 crore.

The three major types of subsidies provided by the government were food subsidies, petrol subsidies and fertiliser subsidies, other subsidies such as assistance provided to state agencies, agricultural produce, price support schemes, etc.

Chances are likely that subsidies will remain unchanged for FY 2024-25 as well.

Disinvestment Target

Disinvestment is the process of the government reducing its ownership stake in the public sector undertakings (PSUs). It can be done through selling shares of the PSU, merging PSUs, and liquidating PSUs.

The disinvestment target of the government for FY 2023-24 was INR 51,000 crore, we can expect a decline in upcoming interim budget as the target of the previous financial year is unachieved.

Tax Regimes

We can expect the tax regimes to remain unchanged for the FY 2024-25 since last year there was a major relief in the new tax regime. And if we analyse the previous budgets where the tax structure was changed, it is highly unlikely that this year will bring any major change in the tax structure.

For your reference, have a look at the old & new tax regimes:

Old Tax Regime

| Income Slab | Income Tax Rate |

|---|---|

| Up to INR 2,50,000 | Nil |

| INR 250,000 to INR 5,00,000 | 5% (tax rebate is available u/s 87A upto 5 lakhs) |

| INR 500,001 to INR 10,00,000 | 20% |

| More than INR 10,00,000 | 30% |

New Tax Regime

| Income Slab | Income Tax Rate |

|---|---|

| Up to INR 3,00,000 | Nil |

| INR 3,00,001 to INR 6,00,000 | 5% (tax rebate is available u/s 87A upto 7 lakhs) |

| INR 600,001 to INR 9,00,000 | 10% (tax rebate is available u/s 87A upto 7 lakhs) |

| INR 9,00,001 to INR 12,00,000 | 15% |

| INR 12,00,001 to INR 15,00,000 | 20% |

| More than INR 15,00,000 | 30% |

Read Also: Budget 2024-25: How Will New Tax Slabs Benefit The Middle Class?

Market’s reaction on the Budget Day

Budget announcement day is considered a big event for the general public and particularly for the market participants. The market’s reaction on the budget day is quite volatile, with a history of both positive and negative swings.

Different sectors react differently to the budget depending on the announcements affecting them. Ultimately, the market’s reaction on the day of the budget can be unpredictable.

It is interesting to note that the Budget Day reaction hasn’t been too extreme, with gains and losses not exceeding 2% in 8 out of the last 10 years. An evaluation of market history since 2013, which includes ten regular budgets and two interim budgets, indicates that the Union Budget has been a 50-50 show so far. In the year 2021, Sensex saw its best budget day gain since 1999 and ended 5% higher. We can say that it’s been a bit of a hit-or-miss situation.

Further, experts suggest not to take directional positions before budget announcement day as the budget can significantly impact the market movement, and if the market moves in opposite direction to your trade, that will result in significant losses.

Conclusion

After a successful FY 2023-24, leading institutions like World Bank and RBI estimated India’s growth in FY2024 -25 to be between 6.3% to 6.4%. However, global economic uncertainty and geopolitical scenarios can influence the conclusions of Budget 2024.

Given the elections, majority measures for farmers and middle-class families are probable. Also, investments in infrastructure to boost India’s manufacturing competitiveness can be one of the main agenda of the government in the upcoming budget.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Frequently Asked Questions (FAQs)

Who presents the budget?

Finance Minister of India.

Are markets more volatile near the budget?

Generally, markets are more volatile near the budget day as different investors have different expectations. However, this increased volatility cools off after the announcement of the budget.

Which day will the government present the budget for FY 24-25?

1st February, 2024.

What is subsidy?

A subsidy is a financial aid that the government provides to individuals, businesses, or institutions.

Will the budget for 2024 affect taxes?

Tax changes are possible, but major reforms are unlikely in the interim budget. However, we can expect some new tax exemptions.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle