| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-15-23 |

- Blog

- which is better fixed deposit or residential property investment

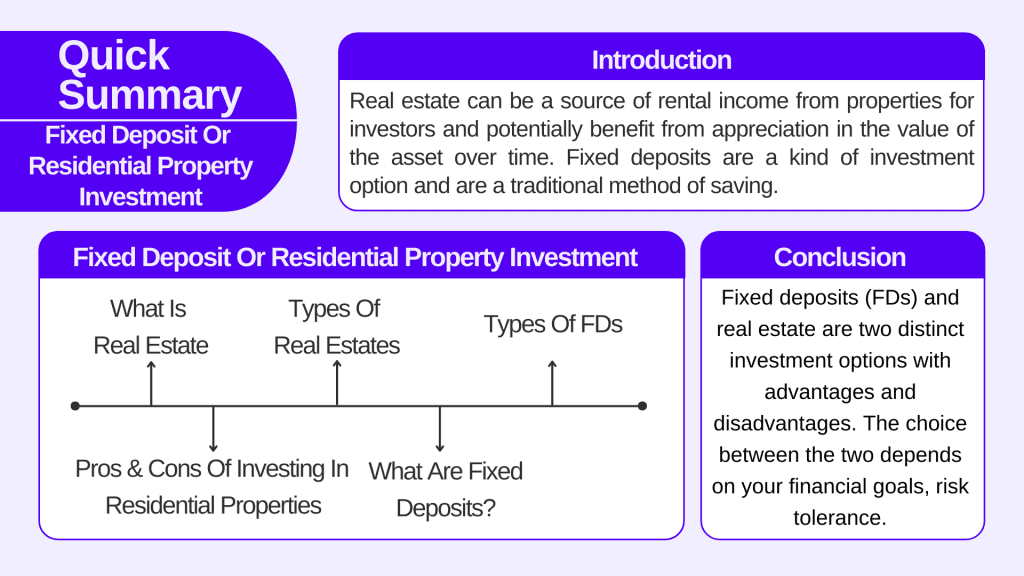

Which is Better: Fixed Deposit or Residential Property Investment

What is Real Estate?

Real Estate is considered as a long-term investment option. It is a kind of risky investment when compared to fixed deposits. Despite fluctuations in the prices of the property over the years, real estate carries great potential to appreciate your invested capital. It’s a broad and diverse asset class that encompasses various types of properties, ranging from residential homes and commercial buildings to undeveloped land and industrial facilities. Real estate is crucial in many aspects of our lives and the economy. Real Estate means a tangible property, including land and buildings.

Real estate can be a source of rental income from properties for investors and potentially benefit from appreciation in the value of the asset over time. Real estate investment trusts (REITs) allow individuals to invest in real estate without owning physical properties directly. REITs are a source of indirect investment in Real Estate. Location is often considered one of the most critical factors that affect property values in the case of real estate.

Types of Real Estates

There are various types of real estate which you should be aware about

- Residential

- Commercial.

- Industrial

- Land

- Special Purpose

Let us go through each of them in detail.

- Residential Real Estate

Any property or area used for residential purposes, i.e., for living, e.g., Individual houses, apartments, etc. - Commercial Real Estate

Properties used to carry out a business like office buildings, hotels, etc. - Industrial Real Estate

This real estate comprises property used for manufacturing, production, storage, and distribution. - Land Real-Estate

Any area that is vacant, raw, and underdeveloped that can be bought and sold is called Land real estate. - Special-purpose Real Estate

Religious places like temples, schools, libraries, etc, serve a special purpose for the general public.

After having an overview of the concept of real estate, in today’s blog, we will be analyzing closely the difference between residential property, which is a type of real estate, and FDs as an investment option. Investment in residential properties involves buying houses, flats, or any kind of residential unit that can provide you with rental income. Though these properties are a good investment option, you should plan and do proper research before investing. Residential properties are a long-term investment option if you want a capital appreciation, and you should also have an exit strategy. Consider factors like when you might sell the property, how you’ll handle market downturns, and whether you’ll reinvest the proceeds. Consulting with a professional who deals in residential properties and financial advisors can be valuable and useful in the investment process.

Real Also: Top Real Estate Stocks In India

Pros of investing in Residential properties

- Generation of high returns over the long term.

- A significant increase in the invested capital.

- Rental income can also be a source of primary or alternative income after retirement.

- Real estate investment can provide investors with tax advantages, such as deductions for mortgage interest, property taxes, and depreciation.

Cons of Investing in Residential Properties

- Initially, it would be best to have a lot of money when choosing residential properties as an investment option.

- Lack of liquidity is one of the major disadvantages when investing in real estate because you cannot sell the property immediately. Certain legal procedures are followed while selling, which can be time-consuming.

- Maintenance costs can be very high, like property taxes, renovation costs, repairs, and insurance.

- A decline in the real estate market will affect property values.

What are Fixed Deposits?

Fixed deposits are a kind of investment option and are a traditional method of saving. Fixed deposits are offered by banks and NBFCs (Non-Banking Financial Institutions). Investment in FDs is a safe option since it gives a fixed return over the years. FDs also offer tax benefits, such as deducting interest income up to Rs. 50,000 per year under Section 80TTA of the Income Tax Act, 1961. FDs are a low-risk investment option with a fixed interest rate, which helps you preserve your capital. You can withdraw your capital whenever you want to, but after a lock-in period only. If capital is withdrawn before the maturity date, a certain penalty amount is charged.

To invest in FDs, you just need to visit your nearest bank branch or apply online. The process takes a few minutes. Suppose you received an amount of Rs.20000 after winning a match, and instead of buying something expensive, you decided to go for a Fixed Deposit. Now, you will visit your nearest bank branch and deposit your money to earn some amount of interest and will just sit back for some years. You will reach out to the bank once again when your Fixed Deposit matures to get your principal amount as well as the interest that you have earned over the years.

Types of FDs

- Regular FDs

- Cumulative FDs

- Non-Cumulative FDs

- Corporate FDs

Let us explain each of them in detail.

- Regular FDs

FD, which offers you a fixed interest rate, and you get back your principal amount with interest at the time of maturity. - Cumulative FDs

In the case of cumulative FDs, the investor gets a return in a lump sum at the time of maturity. Till then, the interest is accumulated and then added to your principal amount. - Non-Cumulative FDs

Regarding non-cumulative FDs, interest is paid to the investor at regular intervals as he chooses. - Corporate FDs

FDs are offered by private organizations and non-banking financial companies (NBFCs) that collect deposits for a fixed tenure and a pre-decided interest rate. The interest rate offered is high when compared to normal bank FDs.

One of the major drawbacks that any investor can face while choosing FDs is that the investor won’t be getting the benefit of inflation-adjusted returns and can also get negative returns at times. How? Let us understand this with an example.

Suppose your investment amount is 5 lakhs. Per the current interest rate (6.7%), interest received would be 33,500. If you lie in a tax slab of 30%, an amount of approximately 10,000 will be deducted from your interest amount, and you will receive a net amount of 23,000 as interest, which is 4.6% when expressed in percentage. Since current CPI, i.e., consumer price inflation, is 7.6%. So, the real interest received is 3% only.

Now, let us come back to our better question. FDs or Residential Investments.

Also, check out Fibonacci Retracement: Complete Guide On How To Use And Strategy.

Conclusion

Fixed deposits (FDs) and real estate are two distinct investment options with advantages and disadvantages. The choice between the two depends on your financial goals, risk tolerance, investment horizon, and circumstances. Choosing between both investment options can be a tough task. However, if you are willing to take on more risk to generate higher returns potentially, then real estate may be a better option for you.

FAQ (Frequently Answered Questions)

Which is the better investment option, Residential properties or FDs?

Both investment options have their own merits and demerits. It would be best if you chose as per your financial goals.

Are FDs tax-free?

No, fixed deposits are not tax-free.

What are cumulative fixed deposits?

The investor gets a return in a lump sum at the time of maturity. Till then, the interest is accumulated and then added to your principal amount.

Are FDs more risky than residential properties?

No, FDs are less risky, whereas investments in residential properties are riskier.

What kind of income can we earn from residential property?

Rental income can be earned from residential property.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.