| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-20-23 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- why it is essential to teach your children about saving and investing

Why It Is Essential To Teach Your Children About Saving And Investing

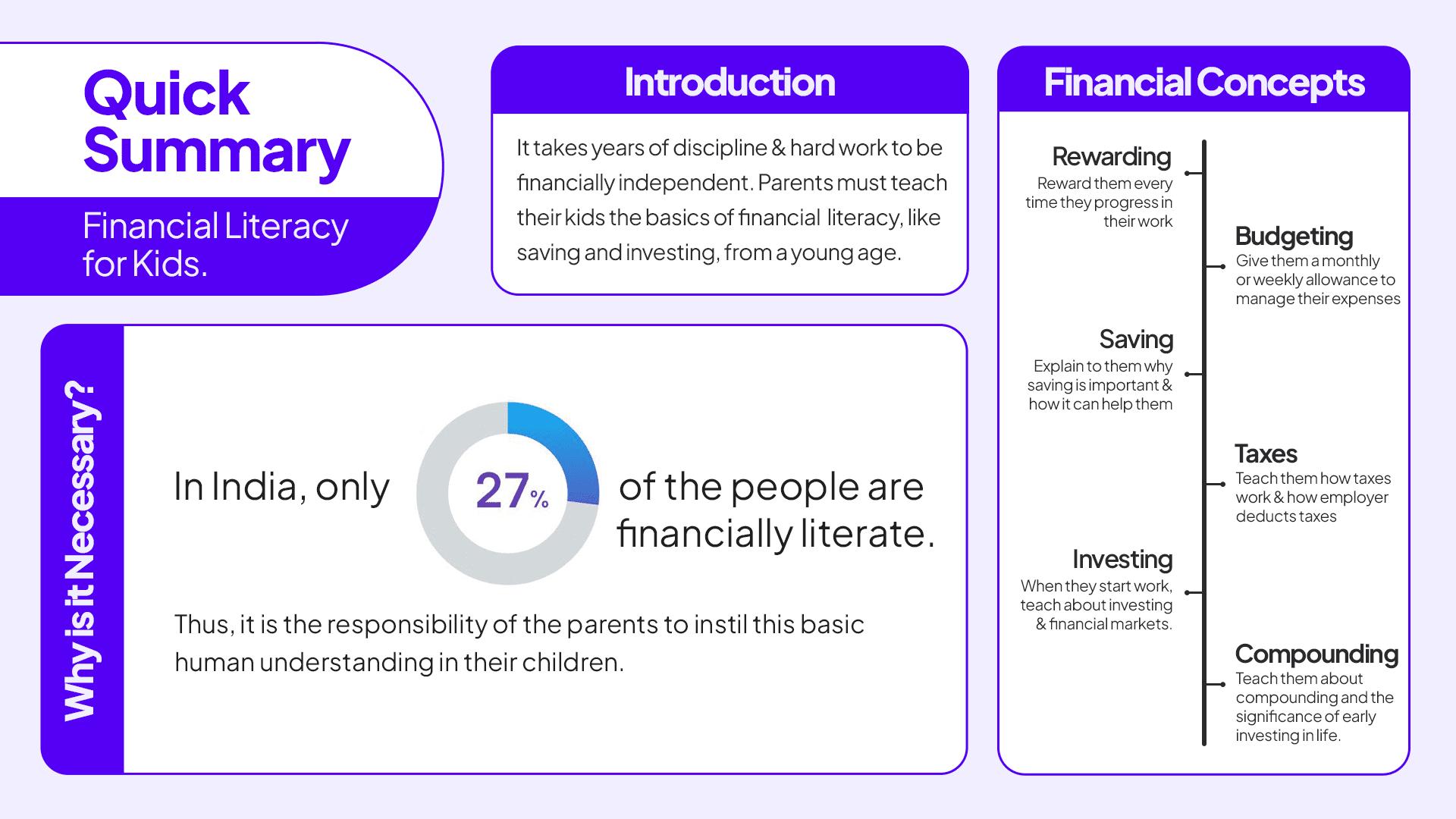

According to the Pew Analyzed Census Bureau data, only 24% of adults are financially independent before age 22, to that of 32% in 1980. Most adults today complain that they were, never taught about financial independence in schools or at home. It is because of this reason, they struggled with their finances in the later years of life. Financial knowledge is not something that you can learn in one day, month or year. It takes years of discipline and hard work to be financially independent. Parents must teach their kids the basics of financial literacy, like saving and investing, from a young age.

Addressing the above problem. Today, we will discuss about the importance of teaching your children about saving and investing.

Why Do We Need To Teach Financial Literacy To Our Kids?

Have you ever seen the construction of a building? Laying a strong foundation for the building is important, to make it last for years. Similarly, to achieve financial independence, it is necessary to give financial literacy to children from a young age.

But, what exactly is financial literacy?

Financial literacy

Financial literacy is understanding the behaviour and working of money to make sound financial decisions like budgeting, asset building, loan financing and debt repayment. Having financial knowledge helps a person to feel empowered. Moreover, people with better financial education are less likely to be financially vulnerable in future. According to research in India, only 27% of the people are financially literate. It means only 1 out of 5 Indians are capable of making their crucial money decisions by themselves. The numbers are bizarre because dealing with money is one of the most customary aspects of human well-being.

Thus, it is the responsibility of the parents to instil this basic human understanding in their children.

Why Build a Strong Financial Foundation?

- To build a strong financial foundation, children should be made familiar with basic concepts like saving and investing from a young age.

- Saving is that part of your income that is left, after spending upon your consumption. Any person who has just started earning spends a prominent chunk of their income on consumption and saves little to no amount.

- But, as they grow professionally, they start saving more for their future & the people dependent on them. Saving helps to build a cushion to rely on during uncertain times.

- Investing is putting your money to work. Heard this famous quote, “Rich doesn’t work for Money, Money works for them” Weird right? But true.

- By putting your money into Assets, you can make your money work for you even when you are not working. For example, investing in real estate could earn you a rental income and give you capital appreciation in the long run.

Parents should focus on securing their children’s future financially but also focus on building and developing their characters. So that, in case of future uncertainties, they can fight through.

Preparing for Future Financial Challenges

The majority of the people feel anxious when asked about their financial situations. As we grew, we realised that we weren’t ever, taught about financial education in our schools or colleges on which we’re supposed to make real-life decisions. How many of you have learned about finances in your schools or colleges?

I could confidently say that none. Our educational curriculum was never designed in a way to help us with our day-to-day problems. Most adults even today, don’t even know that there are options other than FD and mutual funds to invest in the markets.

Providing your children with early financial knowledge could help them to have a better future.

Introducing Financial Concepts to Children As They Grow

First, introduce them to the notion of money at a young age. Its importance, how it works, why it is necessary & other things related to it

- Rewarding- Reward them every time they progress in their work, like for every book they read. Give them a certain amount of money as a reward or when they complete their homework on time.

- Budgeting- Give them a monthly or weekly allowance and tell them to manage their expenses in that fixed amount. Explain how they should allocate their money towards their needs, wants and savings.

- Savings- explain to your kids why saving is important and how it can help them. Encourage them to Save a portion of their allowances or paychecks (when they start working).

- Taxes- When they grew a little old and started doing part-time work. Teach them how taxes work and how employer deducts taxes from their paycheck.

- Investing- When they start to work, teach them about investing and financial markets. Explain to them how they should build assets.

- Compounding- Teach them about compounding and the significance of early investing in life. Financial literacy is something that everyone should learn about. No matter your profession or field of interest, money is something that we all deal with daily.

Therefore, every person needs to be financially independent & financially literate in life because life is very uncertain.

Conclusion

If you are a parent or a guardian to any child, now you know why you must teach them about finances. No parent wants to see their child. Therefore, they must teach kids about money, which they were never taught about by their parents. It is easy to instil good habits in children at a young age as they are growing. Apart from just giving financial learning, parents should also start to save and invest early to give their children a more secure future.

FAQs (Frequently Asked Questions)

Why financial literacy is necessary?

Financial literacy is necessary to make sound financial decisions in life. Money is something that we all deal with on a day-to-day basis.

How to improve financial literacy?

To improve financial literacy you can read finance books like ‘Rich Dad, Poor Dad, ‘Think and Grow Rich’, ‘And Intelligent Investor’ to learn about the stock market.

Why financial literacy is essential for students?

Financial literacy is essential for students as it helps them understand how to make real-life money-related decisions once they start earning.

Is it necessary for children to learn how to wisely spend their money?

Yes, children need to learn to wisely spend their money.

How to explain investing to a beginner?

You can learn investing by understanding the basic technical jargon like return, risk, portfolio etc. After that, you consume content from different sources like books, online platforms & courses.

Financial literacy

Why financial literacy is necessary?

Financial literacy is necessary to make sound financial decisions in life. Money is something that we all deal with on a day-to-day basis.

How to improve financial literacy?

To improve financial literacy you can read finance books like ‘Rich Dad, Poor Dad, ‘Think and Grow Rich’, ‘And Intelligent Investor’ to learn about the stock market.

Why financial literacy is essential for students?

Financial literacy is essential for students as it helps them understand how to make real-life money-related decisions once they start earning.

Is it necessary for children to learn how to wisely spend their money?

Yes, children need to learn to wisely spend their money.

How to explain investing to a beginner?

You can learn investing by understanding the basic technical jargon like return, risk, portfolio etc. After that, you consume content from different sources like books, online platforms & courses.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle